Klima DAO is described as A carbon-backed digital currency and algorithmic climate protocol. The team behind this inspiring project is preparing for a massive launch in just a few days. Over the past couple of weeks Klima DAO has gained almost 20,000 new members and followers across Discord and Twitter.

“We go live on Polygon mainnet next Monday, 18th October 2021 at 8pm UTC.”

Polygon is a sustainable, efficient network on which Klima is building. To participate, get some $MATIC tokens ahead of time so that you can interact with the protocol.

Would you like to create a tokenised carbon offset for a project? Token Bonding is the most cost-effective way to acquire $KLIMA as the protocol will deliver the user a discount in return for BCT/KLIMA LO and BCT/USDC LP bonds. To bond, you must acquire BCT from Sushiswap, or purchase VCUs and bridge them using the infrastructure developed by Toucan (formerly CO2ken). Toucan Carbon Bridge by Klima DAO is a trusted way of bridging these economies. Here’s how it works...

The Carbon Bridge

The Carbon Bridge brings carbon assets on-chain as tokens. With tokenised carbon, anyone can use DeFi to offset their carbon emissions. In the voluntary carbon market, rules and requirements are set by carbon standards authorities, such as Verra’s Verified Carbon Standard and Gold Standard, with others making up less than a quarter of total offsets issued today. Carbon projects must adhere to strict requirements and processes set by the standard, with specific verification and accounting methodologies.

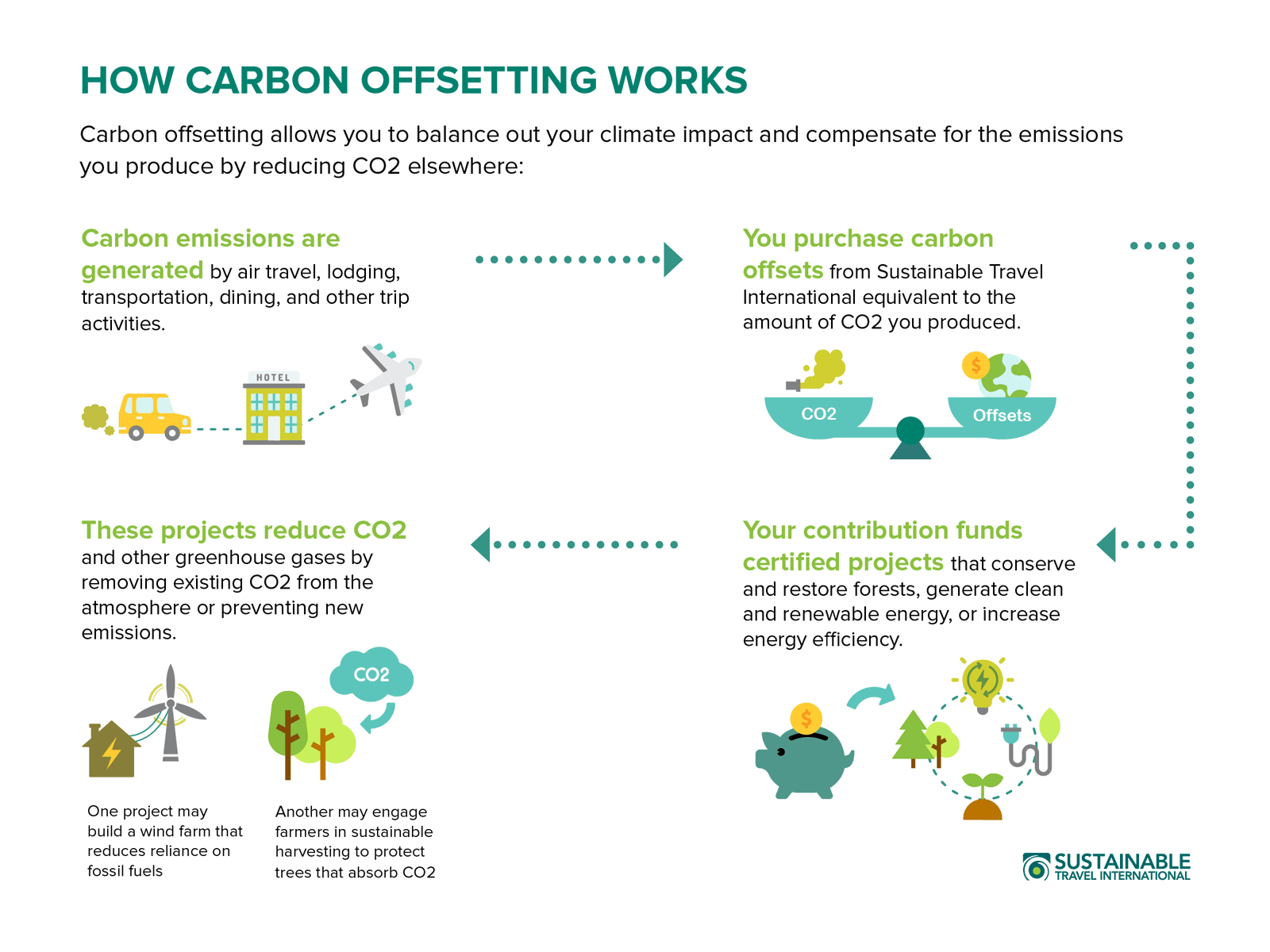

A carbon offset represents a measurable and verifiable removal, avoidance, or reduction of greenhouse gas (GHG) emissions - a tonne of C02 equivalent that is NOT in the Earth’s atmosphere.

The Bridge creates project-specific Toucan carbon offsets (TC02s) by provably retiring carbon offsets in legacy carbon registries. This bridges the gap between carbon tokens and traditional carbon registries. TC02s are ERC20 tokens compatible with most DeFi protocols.

Klima DAO functions as a decentralized market-maker by setting up tokenized carbon pools, where multiple project-specific tokenized carbon tonnes (TC02 tokens) are bundled into more liquid carbon index tokens that enable price discovery for different classes of carbon assets. Carbon index tokens can be traded on DEXs which enable price discovery for various types of carbon assets or to be used as collateral in DeFi applicatons, such as lending markets.

The lifecycle of a Carbon Credit

After projects have proven that they’ve removed or reduced GHG emissions, they are issued offset credits in an active state. Projects typically sell their offsets to intermediaries such as brokers, resellers and retailers. These offset credits can pass from one hand to another without changing their status. As soon as an end buyer wants to use the offsets to compensate for their GHG emissions for accounting purposes, the offsets will need to be retired. It has then fulfilled its ‘duty,’ and nobody else will therefore be able to claim the carbon removal or reduction for their books.

The Clima DAO Offset Module enables projects to make immutable and fully transparent compensation claims.

Let's take a practical example: As a forestry project operator in Columbia that is certified to issue Verra standard claims, you will create your TC02s through the Carbon Bridge, which enables your Verified Emission Reduction vertificates to be tokenised and included in Carbon Pools, for which you receive liquid carbon index tokens. A specific Carbon Index Pool may contain a mix of assets such as base carbon tonne (BCT) and soil carbon tonne (SCT) credits. Now the tokens can be traded through green NFTs, DEXs, carbon-backed currencies, lending protocols, or for Green Mining.

The incredible response to Klima DAO by the crypto community, as evidenced by huge demand for the Klima token and rapidly-growing online community, is a clear indication of the huge potential of decentralised and tokenised carbon markets.

Article adapted from Klima DAO material.