The IXO Token

$IXO is the native staking token of the ixo-Cosmos Internet of Impact Hub.

Staking IXO tokens in the Impact Hub network gives stake-holders the rights to participate in the Internet of Impact economy, receive staking compensation, access the applications and services of the Internet of Impact, and participate in governance.

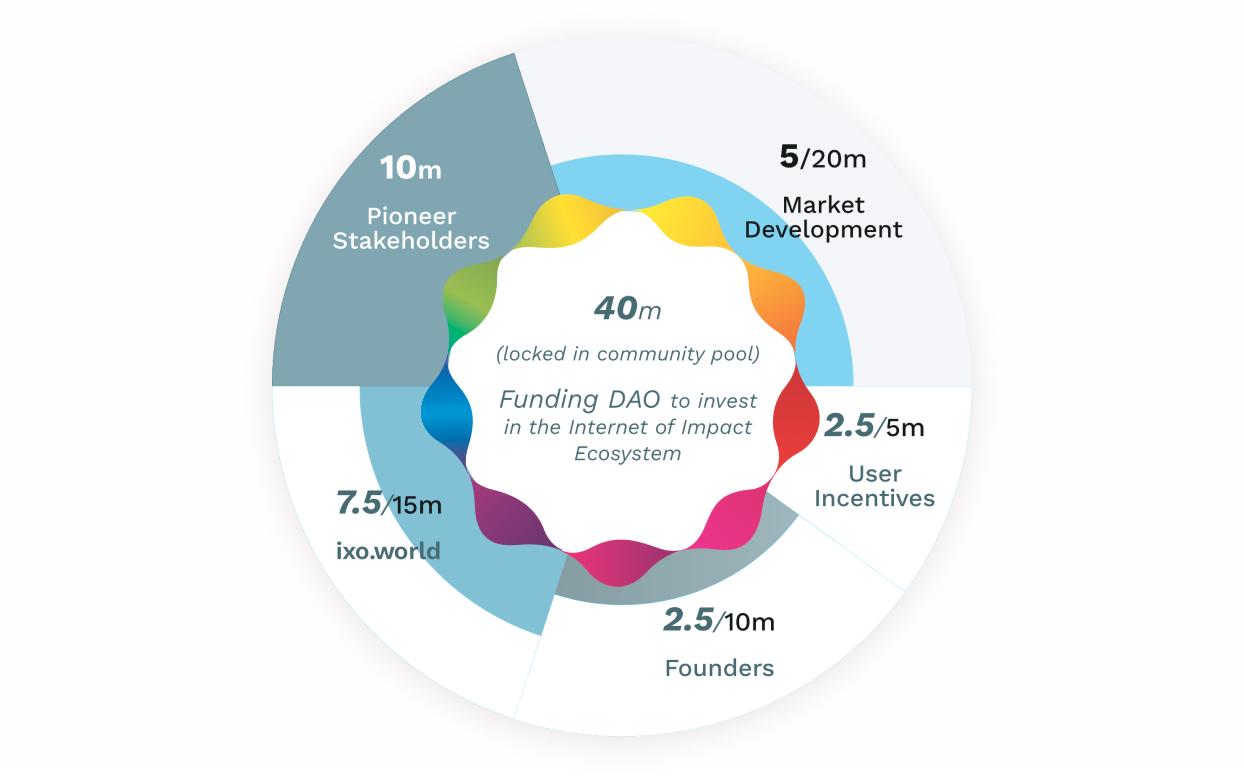

IXO Token Supply and Distribution

100 million IXO tokens were created at genesis by the Impact Hub validator network, with the following initial distribution:

- 40 million IXO (40% of the Genesis Supply) allocated to the network Community Pool, governed by actively staked token-holders, for future investment into the Internet of Impact ecosystem. This pool of tokens will remain locked until a DAO is established to invest in the growth of the Internet of Impact ecosystem. The Community Pool does not directly receive Staking Rewards.

- 5 million IXO to User Incentives with 1 million IXO earmarked for IXO token airdrop distribution.

- 20 million IXO to Market Development, with a 24-month deployment schedule, for investment into the organisations using the Internet of Impact to build platforms and services that serve a wide range of impact market sectors and geographies.

- 15 million IXO to ixo.world AG, the company owned and controlled by the non-profit ixo Foundation, to set up Internet of Impact networks and support its usage.

- 10 million IXO to Pioneer Stakeholders who funded and contributed to the project's development since 2018.

- 10 million IXO to Founders (with a 24-month vesting schedule).

Staking Yields

Staking Yields compensate Delegators for the work they perform in securing and governing the Impact Hub network (explained in the sections that follow).

To translate Staking Rewards into annualised yields, divide the total number of new IXO tokens minted by the total number of staked IXO over a period. (Staking Rewards are only distributed to currently staked –Delegated– IXO tokens).

Staking Rewards are yielding an APY of close to 100% at the time of publishing this post.

Over time, as the network security hardens by more IXO tokens being bonded into the Validator nodes, staking yields are expected to decline. As an example, the Cosmos Hub currently yields closer to 10% APY.

Purpose of the IXO Token

IXO tokens provide economic security to the Impact Hub network through the Tendermint Delegated Proof-of-Stake mechanism. The IXO token may in future be staked for providing shared security to autonomous Impact Hub Zone networks.

Transaction fees ('gas') on the Impact Hub are also paid in IXO tokens, though the cost of these fees is low.

IXO is not a payment token, in terms of e-Money regulations. Payment tokens, such as the eEUR from the eMoney Network may be used to pay for services or for P2P payments on the Impact Hub.

IXO could also potentially be used for a variety of other staking purposes, such as:

- Work Staking may afford stake-holders the right to perform work, which may be compensated through revenue-sharing. For financial and tax accounting purposes, work claims may be captured using the ixo verifiable claims protocol, for income to be verifiably linked to work contributions.

- Service Staking may offer users access to additional services, message processing (gas), claim submissions, oracle services, data hosting, governance proposals, listing projects, digital asset and credential issuance, identity verification, membership registration, subscriptions, dispute-resolution, and rental of digital assets.

- Liquidity Staking allows IXO to be supplied into token-swap liquidity pools and other types of automated market-maker mechanisms.

- Collateral Staking may offer stake-holders the opportunity to bond IXO tokens as collateral in loan guarantee mechanisms, to provide performance guarantees, curate registries, or participate in Alphabond Risk-prediction option pools. Liquid Staking is a set of mechanisms which could in future allow for delegated IXO tokens to be used as collateral for various types of staking derivatives, which will make these bonded assets more productive.

- Membership Staking may offer stake-holders additional benefits, value-added services, entitlements, and discounts from network application and services providers, with many potential configuration options, such as service-providers requiring users to hold minimum stakes of IXO Tokens, together with self-sovereign digital credentials.

- Governance Staking may afford stake-holders the right to submit and vote on various types of governance proposals. Depending on the type of voting procedure implemented, the quantity of IXO tokens held by a Stakeholder may be used in weighting the results. Governance Bonds (using the ixo Alphabond mechanism) may yield governance rewards as an outcome incentive.

Staking IXO Tokens

Staking (also referred to as Delegation, in the context of dPoS Staking) is the mechanism of locking up –bonding– a digital asset to provide economic security for public blockchains. By staking their IXO tokens in Impact Hub validator nodes, IXO token-holders (known as Delegators) to become economic stakeholders in the Internet of Impact.

Staking gives Delegators the right to perform services that secure, govern, and grow the value of this essential digital infrastructure for sustainable and regenerative digital finance, impact verification and tokenisation, as described in the ixo Internet of Impact White Paper.

For providing these services and allowing Validators to "rent" their tokens, Delegators receive staking compensation, the form of Staking Rewards.

Staking Rewards come from new IXO tokens being continuously generated by the network protocol at a rate that is decided through network governance. Staking Reward tokens are automatically distributed to Delegated Stakeholders. The initial inflation rate of 20% for the Impact Hub was set through a network governance vote.

This inflation rate provides an incentive to secure the network, by targeting a minimum percentage of 67% IXO bonded into the Delegated Proof of Stake mechanism. When the minimum network-wide staked percentage falls below this threshold levels, the rate of inflation may be incrementally increased. Conversely, when the the percentage of staked tokens approaches or exceeds this target threshold, the rate of inflation may be incrementally decreased.

Validators retain a commission on the rewards which are continuously distributed to actively staked Delegators. Commission rates are market-related and determined by each Validator. The commission earned by validators contributes to the hosting and employment costs of operating validator node infrastructure. Commission rates can be seen on any staking application interface.

Delegator stakes can be unbonded, or re-delegated to alternative Validator nodes. The un-bonding process takes 21 days, with no staking compensation earned during this period. Re-delegation is immediate and continues to yield staking compensation.

Staking incurs risks of economic losses which Delegators must take into consideration when choosing Validators, or making the decision to stake. If a Validator Node compromises the network security (by going offline, for example), the protocol imposes a penalty by slashing a percentage of the bonded IXO tokens, which are 'burnt'. All Delegators in the penalised node have the same percentage of their Delegated share of IXO tokens removed. Although slashing events are uncommon, Delegators must choose reliable validators to minimise their risks. The historical perfomance of each Validator can be viewed on block explorers, such as ixo Blockscan.

The Impact Hub Network

The Internet of Impact Hub is a global ixo-Cosmos blockchain network that interconnects Internet of Impact networks and provides the trusted digital infrastructure essential for sustainable, regenerative Decentralised Finance applications and to grow the Tokenized Impact Economy.

Sovereign Impact Zone networks implementing the ixo protocol will interconnect through the Impact Hub, to access the universe of blockchain networks through the Cosmos Hub, with bridges into Ethereum, Bitcoin and other major blockchain networks.

The ixo Protocol is establishing the new standard for making verifiable claims about changes in the state of the world, and to tokenize verified outcome states as NFT Impact Tokens.

Users and application-providers of Internet of Impact networks will have access to all inter-connected blockchain networks' services, economies, communities, and marketplaces. Anyone will be able to access the sustainable and regenerative decentralised finance applications, impact verification services, impact oracles, tokenized impact economies, and impact marketplaces built on the Internet of Impact.

Through these powerful network effects, it will become possible to achieve Internet-scale utility and user adoption of blockchains for social, economic and environmental sustainability and ecological regeneration and massively scale responses to the global Climate Crisis.

The Tokenised Impact Economy creates unprecedented opportunities for innovation and will direct massive flows of capital into a new generation of digital assets, such as NFT Carbon Tokens, with huge growth potential for tokenized markets in health, education, sustainable food production, biodiversity, sustainable goods and services, and the creation of jobs for the Green Economy.

Regulatory Status

The IXO Token has been issued by ixo.world AG in full compliance with applicable laws and regulations in Liechtenstein. The IXO Token is legally classified as a utility token according to US, Singapore, European and Liechtenstein laws.

Not financial or tax advice. This article is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. For tax advice talk to your accountant. Do your own research.