Financial Protocol DAOs as Decentralised Development Banks

This article is a work in progress. The first draft was published on 28th November, 2021.

In the quest to scale from billions to trillions of dollars in capital that needs to be directed towards the global sustainable development goals and into climate finance, crypto economies will become part of the solution to form large volumes of capital, and to allocate this capital to where it is needed.

This is already happening. Financial Protocol DAOs are a fast-growing phenomenon. In recent months we have seen the birth of a movement towards these types of DAOs being purposed towards financing sustainable social, economic and environmental development, and climate impact mitigation.

The most well-established and successful demonstration of this phenomenon is MakerDAO, the decentralised treasury mechanism that governs the $DAI algorithmic stable token.

Since launching in 2019, the $DAI asset-backed stable currency that is pegged to the USD has grown to a market cap of almost $USD 6.5 Billion. In a recent MakerDAO governance forum post entitled The Case for Clean Money, Rune Christensen (founder) describes how Maker has the potential to impact the deepest layers of finance as a new financial backend, and he makes the case for MakerDAO to transform into a Purpose DAO that can "coordinate the global build-out of sustainable energy pathways by funneling billions of dollars into senior credit positions for projects that will build solar farms, wind turbines, batteries, recharging stations and other cost-efficient renewable energy solutions, as well as their supply chains, sustainable resource extraction and recycling."

Maker can help to fix the broken core of the global financial system itself and the bad incentives that’s driving it towards its own demise. –Rune Christensen

Admittedly it's still very early days, but this area of blockchain innovation is going to become an engine for driving growth of the tokenised impact economy. In this future tokenised impact economy, the definition of money could be fundamentally transformed from Fiat Money into People’s Money. The basis of local –and possibly global– economies could become regenerative, backed by Earth Assets with wealth generated from nature-based and regenerative products and services, such as renewable energy.

The open-source blockchain mechanisms with which Financial Protocol DAOs can be created are easily replicable, and can be quickly evolved for new use-cases and financing innovations.

In the remainder of this article I share further thoughts on:

- How traditional banks create money

- How decentralised finance protocols create money

- How Finance Protocol DAOs can govern the creation of money

- How DAOs can allocate capital for a purpose

- How we can ensure the capital allocated by DAOs achieves its purpose

- Financial Protocol DAOs as Decentralised Development Banks

I'm not an economist, so I welcome critique and discussion of these ideas, in the comments thread below.

How traditional banks create money

Central banks, such as the US Federal Reserve, create the supply of national currency through issuance mechanisms such as treasury bonds, and they moderate inflation of the currency supply by setting treasury Interest rates.

The cost of capital in the fiat economy therefore originates from a central bank’s interest rate, with layers of fees and losses added through the capital supply chain.

Commercial banks are also licensed to amplify the currency supply by issuing debt backed by fractional reserves of central bank money, on which they charge Interest. All this Interest feeds into funding the operations of these capital supply chains and into the pockets of people who work for banks and suppliers to the banks, with profits externalised to the shareholders of the bank and their suppliers.

The cost of capital for the borrowers of fiat capital, therefore includes a fat layer of capital supply costs that ultimately add to the debt burden of the real economy, where a proportion of this capital supply gets used for the production of goods and services, whilst a much bigger proportion of the capital supply gets used for trading in financial markets, with banks as intermediaries. There is growing interest by central banks to implement digital currencies and China has already issued a digital Yuan, but these Central Bank Digital Currencies (CBDCs) come with no guarantees that they will fix the legacy problems of centrally-issued money supply, and could potentially introduce new threats to personal liberties that exacerbate financial exclusion.

Why is this important? We need better systems of money supply, to provide much more capital, at a much lower cost to borrowers, to make investments into financing sustainable development, ecological regeneration and climate impact mitigation.

We can also do a lot better as humanity by backing our money with Earth Assets that regenerate the real wealth of our planet’s ecology, and produce a sustainable existence for us all –including future generations. In his conference presentation, 'From Degen to Regen', Regen Network co-founder Gregory Landua made a compelling case for this new form of currency.

How Decentralised Finance Protocols create money

Token Liquidity is what fundamentally drives decentralised finance. In the past, most token liquidity was created out of thin air, either through centralised issuance mechanisms that mint a supply of tokens –such as ICOs, or through decentralised issuance mechanisms –such as the Bitcoin mining protocol.

Every token has some form of treasury function that governs the initial supply and distribution of the token, and then the ongoing rate of supply goes through some form of inflation mechanism. In some cases the token treasury function includes a supply contraction mechanism, such as token burning. Token treasury functions mimic the functions performed by central banks, but at far lower costs of capital, as there are no intermediaries.

Decentralised Finance innovations have created token supply mechanisms that can be autonomously regulated by automated market-maker (AMM) mechanisms that algorithmically expand and contract the token supply against a fractional liquidity reserve of another tokenized asset. This class of treasury AMMs typically uses some form of Token Bonding Curve algorithm to multiply the supply of tokens against a fractional reserve, and to balance buy/sell demand on the reserve capital by pricing the exchange rate between the reserve token and the AMM token.

An AMM can be designed to expand the reserve supply through intrinsic and/or extrinsic token inflation mechanisms. In this way, liquidity providers effectively receive interest on the capital they have supplied into the AMM reserve.

AMMs can be used to pool liquidity for the purpose of enabling decentralised exchanges between pairs of tokens. But AMMs can also be used to pool capital for other purposes, such as bankless collateralised lending, or other forms of financing, which we will get to later.

How Finance Protocol DAOs can govern the creation of money

Decentralised Autonomous Organisations (DAOs) have become a phenomenal new force for managing token treasury functions, with powerful mechanisms to both form capital liquidity, and to allocate this capital to where it's needed. We have only just begun to see the purposes for which DAO Treasuries can be used.

There are many different types and functions of DAOs and for now I would like to focus on what I call Financial Protocol DAOs that have the specific purpose of creating and governing a money supply treasury, using DeFi mechanisms.

DAOs can govern decentralised treasury mechanisms, such as the AMM token supply mechanisms described in the previous section. The members of the DAO get to set monetary policies, such as a token’s fractional supply ratio –for instance, modifying the parameters of a bonding curve algorithm, and the inflation rate.

Most Financial Protocol DAO treasuries are governed by strongly purpose-driven communities who direct capital from the liquidity mechanism they govern, to where they believe this will have the greatest impacts. Shareholders in the liquidity mechanism are the members of the DAO and they receive the benefit of inflation for their interest, as an incentive for supplying capital into the liquidity mechanism, and for participating in the DAO’s governance. The share tokens held by liquidity providers are used for governance mechanisms, such as weighted voting in proportion to the number of tokens a DAO participant holds. Decisions are therefore driven by the interests and incentives of these DAO shareholders, with the potential hazard that this could be antithetical to the intended purpose of the DAO –as I will explain later.

We now have some powerful examples of how a decentralised treasury DAO works to form and create token liquidity, with compounding yields to liquidity providers.

A notable example is Olympus DAO, which implements a protocol-managed treasury, protocol-owned liquidity (POL), a bond mechanism, and staking rewards that are designed to control supply expansion. The Olympus DAO currency $OHM can only be minted or burned by the protocol.

You can't trust the FED, but you can trust the code.

At the time of writing this, Olympus DAO has more than $800 million in its treasury –most of which is owned by the protocol. The DAO’s currency token $OHM is algorithmically designed to be backed 1:1 by $DAI stable token assets in the treasury reserve pool.

To moderate the free supply of $OHM against demand for this currency, Olympus DAO implements an innovative staking mechanism that incentivises $OHM token-holders to lock-up their tokens. This design is based on the (3,3) game theory that if two actors consider their options to either Stake or Sell, if both choose to stake (3,3) this produces a better outcome for both participants, and for the protocol.

Given these incentives and the benefits of cooperating by remaining staked, more than 90% of $OHM is currently bonded back into the DAO mechanism (currently $3.65 billion in total value locked), which reduces the free supply of $OHM.

This monetary supply restriction mechanism enables the Olympus DAO treasury governance mechanism to set a high inflation rate for monetary expansion, to meet new market demand for $OHM by creating new token supply that is sold for DAI to increase the reserve pool.

The Olympus DAO staking mechanism yields an incredibly high APY of 7,271% through compounding yields, which is sustainable as long as the $OHM currency demand continues to outstrip its supply. This is a powerful DeFi savings incentive mechanism that fully exploits compound interest as the “eighth wonder of the world” and promotes long-term savings.

Stake-holders receive a distribution of the inflation supply relative to their stake, so they are less likely to be diluted out, and won’t see their share deflating in value. The price per share is far less relevant than the total value their stake accrues over time, and this value should –at least in theory– be directly proportional to the value of the treasury assets. The value of investing in a Financial DAO should be directly correlated with value appreciation in the DAO’s assets in its treasury.

By focusing on supply growth rather than price appreciation, OlympusDAO hopes that OHM can function as a currency that is able to hold its purchasing power regardless of market volatility. Investors in Olympus DAO are betting on an ever-expanding demand for $OHM if this becomes “The Decentralised Reserve Currency” in the way that the Olympus DAO founders envisioned.

The OlympusDAO founding team is now offering Bonds-as-a-Service to anyone who wants to set up their own “protocol-owned liquidity” mechanism, with Olympus Pro. Now every protocol can have its own reserve currency.

How DAOs can allocate capital for a purpose

The Olympus DAO mechanism was implemented by KlimaDAO to create a reserve currency that is backed by carbon assets. A previous Earth State article described how the Toucan Protocol bridges traditional carbon certificate assets from carbon registries into NFT tokenised carbon assets, that are mostly owned by the protocol and traded through KlimaDAO carbon index fund bonding curve AMMs. High staking yields encourage long-term holding of $KLIMA and allows participants to benefit from the rising price of carbon. As the protocol generates a profit through Bond sales, this profit is distributed back to everyone who has staked $KLIMA.

Since launching in September 2021, KlimaDAO has accumulated token liquidity that has been used to purchase more than 11,57 million Base Carbon Tonnes of carbon credits and is returning an APY of 40,000%.

The KlimaDAO experiment has already had unanticipated economic impacts by creating a supply-side reduction that moved the global carbon market price up by 25%.

With KlimaDAO we have a brave new example of how a DAO treasury can create savings incentives to finance big-bet investments into the future, for assets that are relevant to climate impact mitigation. The same type of asset-backed currency mechanisms could potentially be used to finance any sustainable development outcomes, if the assets that are purchased with the treasury capital have the potential to appreciate in value; however that value is defined.

For the capital assets that are accumulated into DAO treasuries to be spent in ways that are sustainable and regenerative, ultimately, a significant proportion of this capital must be allocated towards financing goods and services that grow the Real Economy.

Deciding on how and where to allocate capital is therefore an important function of any DAO that is going to make an impact on changing the state of the real world.

For a DAO to deliver sustainable impact, every decision to allocate capital should be based on two fundamental criteria:

- Aligns with the Mission

- Growth rate ≥ 1 generating an ROI greater than 1.0 on average (≥ $1 of value returned back into the DAO treasury for every $1 invested).

DAOs are fundamentally about governance, so every DAO that is effective at making capital allocation decisions that consistently meet these two criteria, should be sustainable and have a real-world impact.

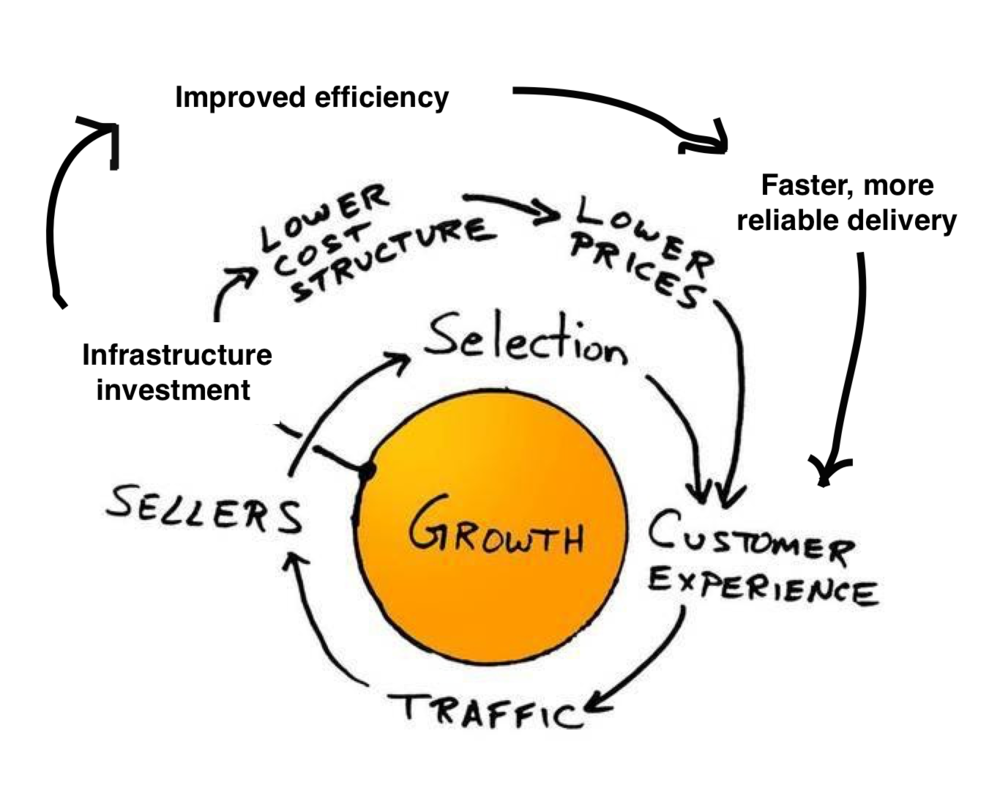

Trent McConaghy, a founder of the Ocean Protocol DAO, describes this conservation principle as the Web3 Sustainability Loop, which is based on the now-famous Jeff Bezos Amazon loop that has been described as the flywheel for Amazon’s sustained customer satisfaction-driven market growth.

The Amazon mission is to achieve customer satisfaction and through virtuous reinvestment of profits back into innovations that increase customer choices and decrease the prices of delivering goods and services. This leads to more delighted customers and continued growth –into new markets and new lines of products and services.

What Amazon has done to achieve this incredible sustained growth is of course not the only concern, as “how” also really matters. At this nascent stage of Financial Protocol DAOs, we generally see how governance can play out in very antithetical ways, as incentives are primarily driven by speculation, rather than the attainment of purpose. Fundamental questions remain about who gets to participate in governance and who has a stake in the financial benefits of staking rewards.

In future Earth State articles we will share the work that the Interchain Foundation Earth Program is doing to strengthen DAO governance inclusion mechanisms, and how the ixo and Regen Foundation are collaborating to set up a multi-stakeholder Earth DAO to invest in growing the sustainable and regenerative tokenised impact economy within the Cosmos blockchain ecosystem, and beyond.

How we can ensure the capital allocated by DAOs achieves its purpose

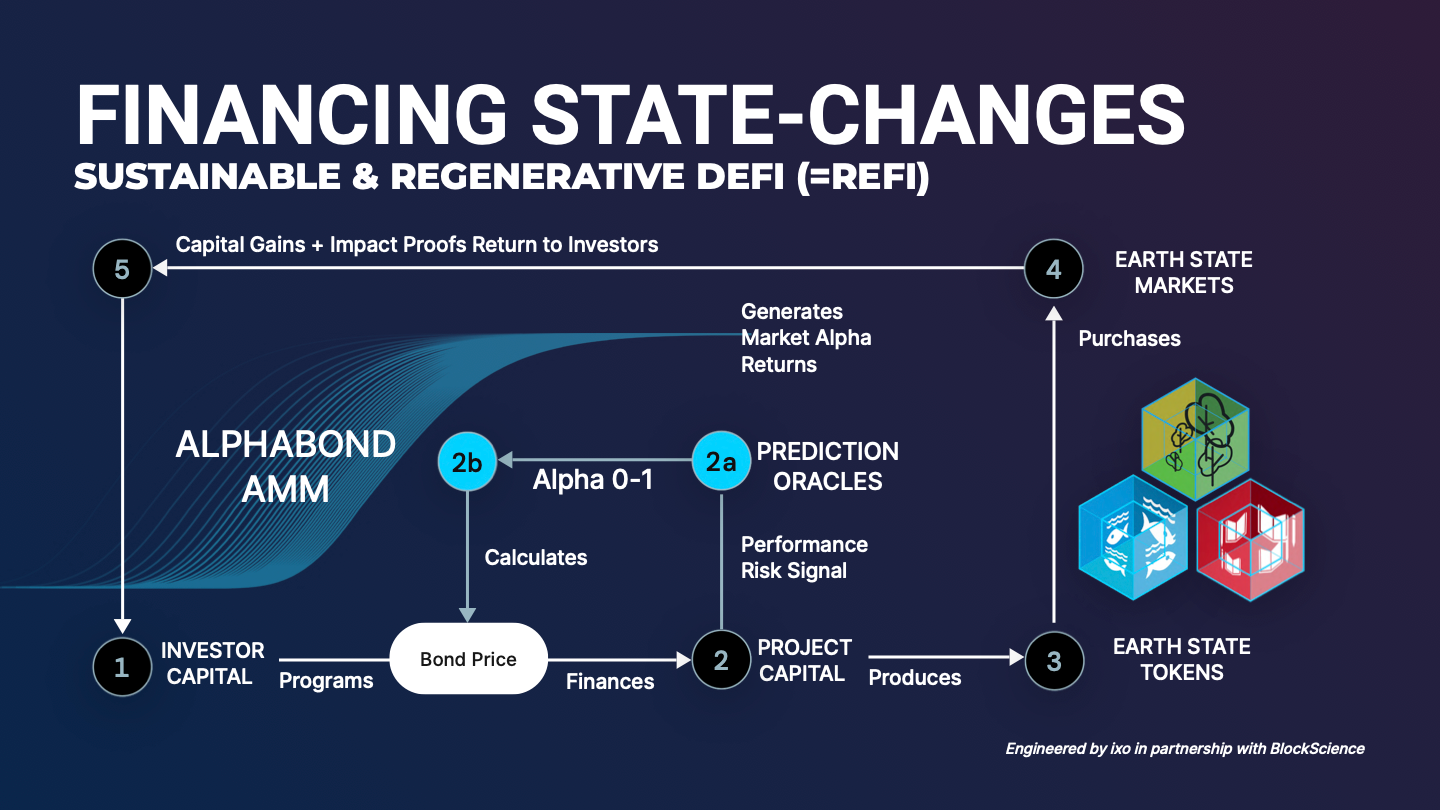

By linking Chain-state with Earth-state, we can create feedback loops that keep DAO capital allocations on-track and on-purpose. This requires systems for verifying claims about changes in the observed state of the real world, and these systems should allow for counter-claims to be made in transparent and accountable ways.

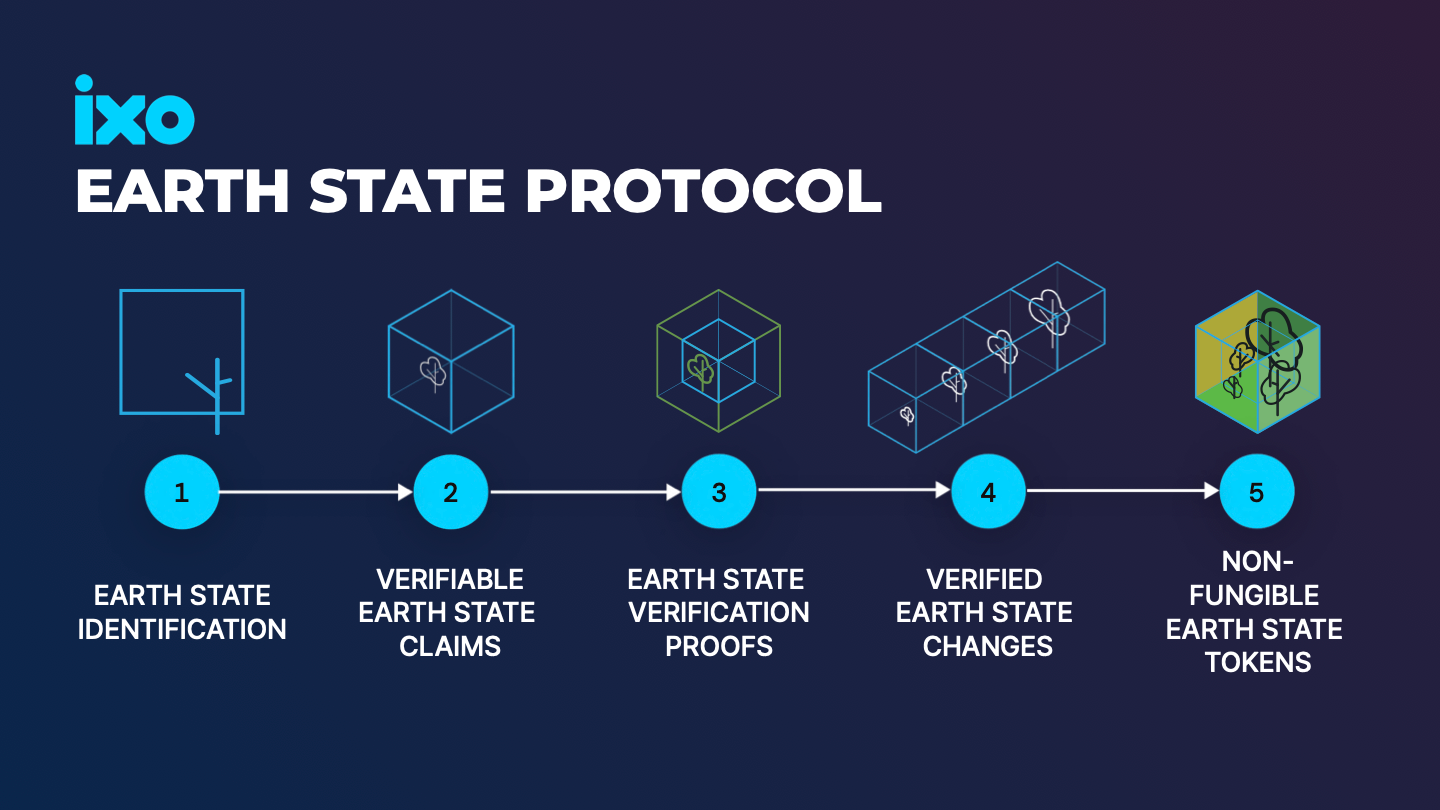

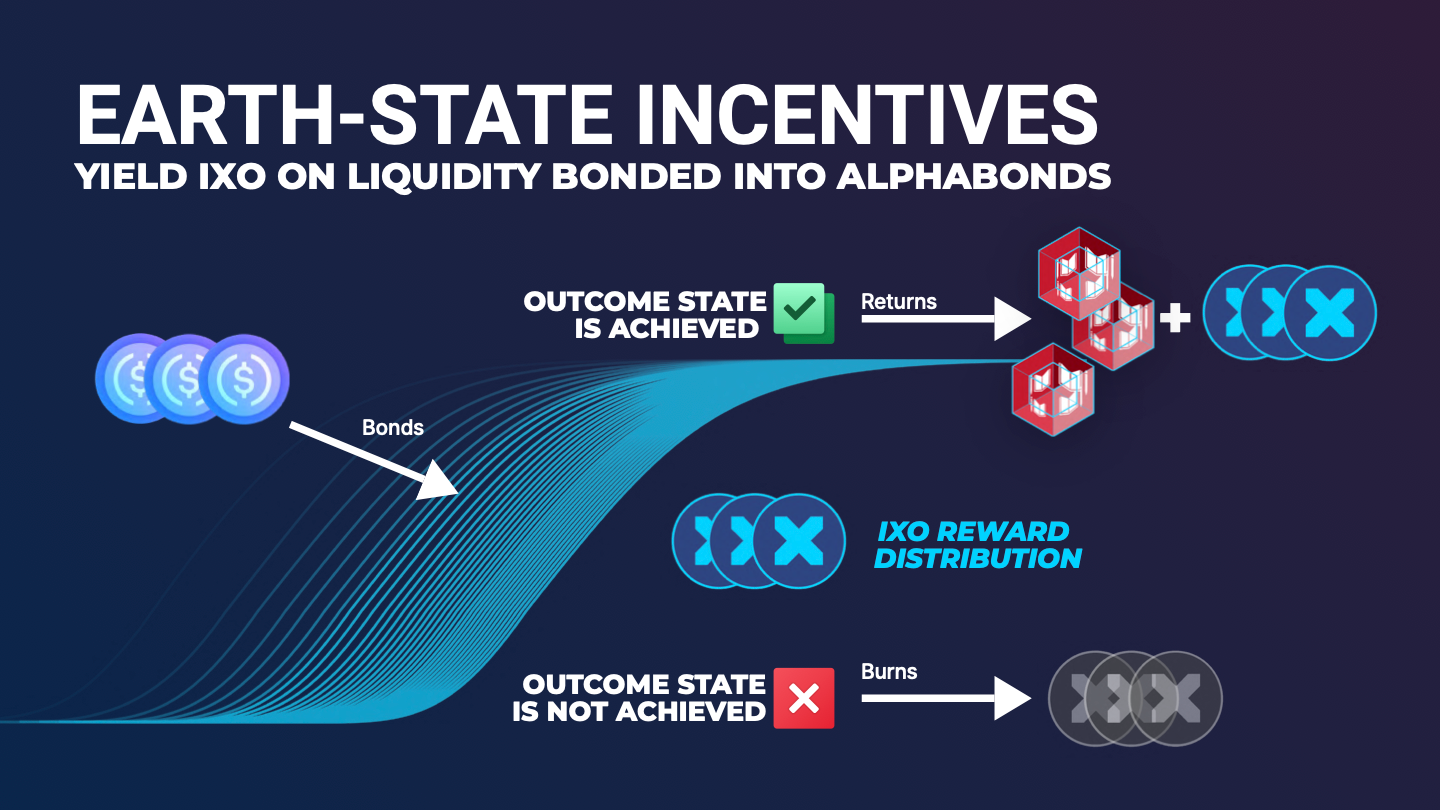

The ixo Protocol describes a set of decentralised web standards for making, and then independently verifying claims with cryptographic proofs, as the basis for issuing verifiable credentials and minting non-fungible tokens that represent verified outcome states. These “Earth Tokens” or “Impact Tokens” can be used to create on-chain representations of any outcome state that people care about and value, want to work towards, are willing to buy, or invest in producing. These new digital assets can represent anything from carbon credits to immunisation status. The assets are backed by verifiable data resources, and are embedded with executable rights.

We are now working on the incentive mechanisms for DAOs to invest into the production and acquisition of this new class of tokenised assets, and the mechanisms for creating liquid markets for pricing and trading these assets. In a future update to this article I will describe the crypto-economic systems design for directing the inflation from Financial Protocol DAOs into incentivising investments through ixo AlphaBonds to produce curated classes of Earth Impact Tokens.

Financial Protocol DAOs as Decentralised Development Banks

Finance Protocol DAOs could quickly become the new decentralised banks for creating and governing currency supply, and asset managers for allocating capital.

This is a big deal for creating new capital markets in the non zero-sum game of directing both government-issued currencies and community-issued currencies towards the purpose of changing the state of the world, and should be seen as part of the solution for moving from billions to trillions of dollars being invested into financing the Sustainable Development Goals and Climate Impact Mitigation.

In conclusion (for now)

We want better systems of money supply for massively scaling capital to finance Earth state-changes that will regenerate the planet and build sustainable prosperity for humanity. Financial capital should be backed by natural capital and human potential.

- We understand how banks create money and that legacy financial institutions have produced a fundamentally flawed global financial system that is in conflict with the sustainability of the planet and future human prosperity.

- We know now that decentralised finance protocols can safely be used to create money, with mechanisms that turn future long-term value into present day cash flows and provide powerful incentives for savings to be accumulated into capital liquidity instruments.

- Finance Protocol DAOs can also (like banks) govern the creation of money and monetary policy, but with transparency, stakeholder governance, carefully designed incentives, disintermediation and decentralisation.

- DAOs can allocate capital for a purpose that is governed by stakeholders in the DAO, which can be directed towards real economy investments. When a DAO consistently makes investments that are purpose-aligned and grow the value of the DAO reserve over time –following the 2 principles of the Web3 Sustainability Loop– the funding pool becomes evergreen.

- We can ensure that the capital allocated by a DAO achieves its purpose by verifying state-changes in the real world using oracles that inform the execution of state-changes in the decentralised finance protocols that are governed by the DAO.

- Financial Protocol DAOs have the potential to serve as Decentralised Development Banks that can be complementary to traditional finance in the non-zero sum game of moving from billions to trillions of dollars being directed towards development and climate finance.

- Critical questions remain about how DAOs for this purpose are governed and who gets to have a stake, considering that there has been very little participation by beneficiary stakeholders to-date. The Interchain Foundation Earth Program, alongside ixo, Regen Foundation, and other collaborators, are setting up the pathways and mechanisms for building meaningful stakeholder participation in DAOs and regenerative finance mechanisms.

DAOs seem set to become the Web3 sustainable and regenerative finance engines that will grow the tokenised impact economy.

It's early days, but these are really important developments that have real potential to scale finance for Earth state change, from Billions to Trillions.