Written by Simone Cicero

Abstract

In this post, we reflect on the difference and convergences between DAOs and Entrepreneurial Ecosystem Enabling Organizations, following some preliminary thoughts that have been shared in our 3EO community. We also take the chance to review some insights coming from our recent webinar with Ben Mosior during which we reflected on the evolution of organizing that Web3 could bring, through the lenses of Wardley Mapping

We’re constantly and actively working on these topics and working to launch a new protocol, so reach out if you’re interested in investing or joining us and subscribe to our newsletter if you don’t want to miss a thing!

A few days ago my colleague at Boundaryless and 3EO ME lead Emanuele Quintarelli came up with a post on our RendanHeYi 3EO Community asking if Rendanheyi and DAOs were “the same”.

For those of you that are not familiar yet, Rendaheyi is Haier’s pioneering organizational model – based on the continuous creation of small entrepreneurial units supported by shared services – that originally inspired our work on the 3EO Framework. It probably represents the most advanced implementation of a common protocol of organizing that is emerging across the spectrum of the most innovative business contexts, based on a set of “key patterns“.

These key patterns include many elements that we find replicated in the DAO perspective. The first one is certainly the idea of seeing the organization as primarily concerned with disbursing capital to unit teams.

In the 3EO/Rendanheyi model, this happens according to certain contracts called VAMs (where VAM stands for Valuation Adjustment Mechanism) that relate the company’s investments with the newly formed unit expected results. These contracts also regulate the team’s access to the unit’s future equity and other levers of skin in the game (such as revenues). Similar patterns exist in DAOs with grant programs and other approaches to capital disbursement but, usually, the team skin in the game is only related to the distribution of tokens.

Another clear parallel can be seen in the use of blockchain-based ledgers and smart contracts that, on one hand, help to store and leverage transparent information, while on the other regulate how nodes interact with each other through self-executing contracts, which in Rendanheyi are called EMCs (Ecosystem Micro Community contracts).

As one can see, there’s some resonance, at least along with some key points: smart contracting, and distributed ownership across the organization (despite in very different ways). Also, the idea that the objective of the organization is to host a somewhat complex decision-making process and institutional architecture that primarily serve to allocate capital to nodes – often called Teams or SubDAOs in the DAO space – that are supposed to reach specific objectives, rings a bell. Furthermore, Haier and other companies using similar models, often rely on an internal reputation systems that resonate with the idea of hosting a public record of members’ contributions and rewards which is also a pillar of DAOs.

What DAOs struggle with

According to Emanuele, despite DAOs having characteristics that recall those of these advanced organizational models that emerged in the world of business (Rendanheyi is not unique and resonates with many other experiences) most of them still struggle with a substantial set of elements that characterize an organization and are essential for an organization to crack the key problems of organizing, such as:

- Setting and evolving purpose and aims;

- Setting strategy and orchestrating efforts;

- Distributing labor;

- Managing operational activities, including meetings and alignments;

- Running an HR process that covers onboarding and performance evaluation;

- Collecting feedback and resolving conflicts;

- The diffusion of values and culture;

...and more.

I’ve been following the evolution of DAOs since the beginning, and the – originally lacking – capability to structure the organization through teams and roles has soon emerged as an important direction of development. We’ve seen how organizational nodes and teams have been embraced lately, our recent post on bootstrapping networks in Web3 covers some experiences with this.

We’re seeing different approaches to team formation emerging in DAOs where clear treasury budget allocations happen and teams gain autonomy in using those budgets: sometimes these teams are intentionally generated by the original DAOs architects, at times in a recognition of emerging structures of work and in an effort to progressively decentralize ownership and decision making; in other cases teams or individuals make requests to access grants – through grant programs or occasionally – and a vote, often global, is cast to formalize the grant agreement.

DAOs are quite efficient at disbursing budgets, but – as Emanuele noted in his internal community update – are normally highly inefficient in strategically disbursing work, and therefore in most cases budget autonomy comes along with scarce strategic alignment. Most of the teams operate on a grant basis where budgets are allocated, and teams have almost always no market orientation, and little or no freedom to generate their own sources of income have no tension for market validation, and likely can’t generate their own equity or mint their own tokens.

According to Emanuele embracing the 3EO/Rendanheyi structure that is essentially based on:

- A network of capital allocation nodes (called Industry Platforms in Rendanheyi);

- Micro-entrepreneurial units;

- And a wide array of inter-unit contracts;

“...would give DAOs the fractal structure they lack for labor distribution and specialization” and having such a granular organization structure would help to “restrict and facilitate decision-making, capital management, budgeting, energizing purpose/aims, and automatic value distribution when a contract has been executed.”

In most of DAOs, tokens represent a precondition for participation in the decision-making process making those systems dangerously plutocratic. Despite the plutocratic nature of such voting systems can be addressed with tools such as quadratic voting, the real point may not only be that of reducing the impact of centralization, but also that of delegating the responsibility of decision making to those that have contextual information and accountability on the scope of the decision.

A too flat or too open voting mechanism too often means either: ratification or polarization.

According to Emanuele’s point of view, three main directions of development shall be considered when addressing the relationship between tokens and decision making:

- Moving toward ownership distribution, the RenDanHeYi naturally caters to the idea of using tokens not only at the enterprise but also at the node level. Individuals could own Micro-Enterprises, Ecosystem Micro-Communities, or other types of nodes, thus being invited to both contribute (through decisions) and benefit (through value sharing) from the node’s life.

- Decision-making should be decoupled from ownership. The possibility to partake in decisions should be a function of the role individuals fill in a node (for example, having lots of expertise or acting as the owner of the node), not of the number of tokens they keep in their wallet. Consent (e.g., not having objections), instead of consensus or majority voting, could be the preferred choice model for nurturing both speed and inclusion in complex decisions. Tokens may instead be leveraged as (one of the) multipliers to compute value distribution.

- Avoid voting as much as possible. The extremely distributed organization design at the core of the Rendanheyi (think about the 3 rights of the Micro-Enterprise [ed. see below]), VAMs, and Industry Platforms) represents a great basis for dramatically diminishing the situations in which voting is necessary. Distributed autocracy, not voting, at the node level, is more than sufficient once roles and responsibilities are clear.*

Edited – The Three Rights of Micro-Enterprises in Rendanheyi are:

- The right to make decisions;

- The right to hire talent;

- The right to distribute compensation.

Integrating such elements would oblige DAOs to look into how decision making happens inside the sub-nodes, facing the question of coupling unit’s rights with unit’s accountability: for example considering how a positive Profit & Loss statement entitles a unit to self-manage a budget surplus, without the need of voting around it.

Another rather essential point that Emanuele raised in his recent community reflection is the need to feature enabling services in the enactment of the organizational structure. 3EO/Rendanheyi indeed provides guidance for the construction of a “middle layer” composed of:

- Industry Platforms that are intended for driving certain strategic directions across the organization through capital allocation, in accordance with strategic choices;

- Shared Service Platforms that are responsible to provide standardized and optimized support services;

- Node Micro-Enterprises that are supposed to provide internally optimized business services.

We have to recognize that despite DAOs are born to transcend bureaucratic organizations they too often find themselves in a rather top-down model of capital allocation where the need to disintermediate, avoid managerial power, and keep everything fluid and impersonal, eventually brings up a situation where: someone designs the team structure and allocates budgets (or designs grants) and token-holders ratify.

The lack of capacity to evolve organically with the market is outstanding and dangerous. This issue is clearly related to the lack of “unbundling”: as the purpose of the DAO is often very specific (e.g.: evolving a protocol) there’s often a very limited interest and focus on making the organization able to explore adjacent futures in terms of new products to build, or new spaces to explore.

Such a model of organizational evolution and management seems very much contiguous with the experience of foundation-backed open source software, and it may be optimal for protocols (is it?) but definitely not for organizations spanning across the different layers of a complex Value Chain.

So what are DAOs for? How should we think about them in the future of organizing?

As we’ve highlighted above and as the market is telling us clearly, at the moment we can identify DAOs as organizations optimized for:

- Looking after a slowly evolving protocol specification and adoption;

- Distributing a treasury mainly through grants responding to an emergent (and scarcely organized) proposals process;

- Occasionally invest in the creation of products that drive the adoption of the underlying protocol.

As we’ve explained in our recent post on bootstrapping Web3 networks though, we also see different behaviors emerging, and new institutions being created, that call themselves DAOs or simply networks, follow slightly different paths (such as Braintrust).

On the other hand, we see incumbents, large organizations, and sometimes small and emerging ones, adopting behaviors that are – at times – resonate with the ideas behind DAOs, bringing up complementary elements that may be worth integrating.

We should thus ask ourselves the most complex question: how will the conjunction of such trends impact the organizational landscape?

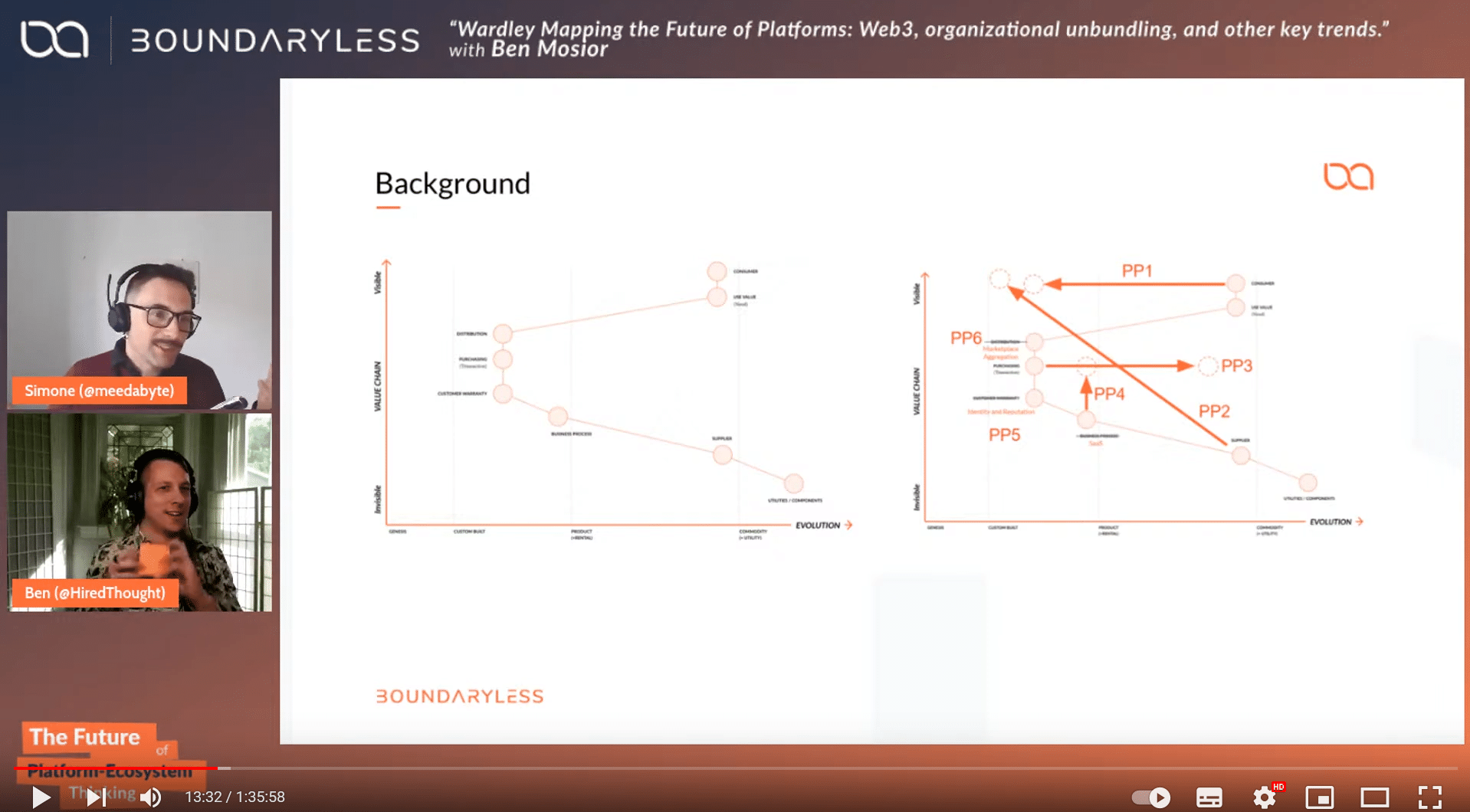

A few days ago I tried examining the evolution of the landscape through the lenses of Wardley Mapping with Ben Mosior during a 1.5 hours webinar.

The first part of the webinar was dedicated to understanding how we’ve been approaching Wardley mapping so far (and how this can evolve), and in the second part, we spent some time considering how trends such as Web3 could impact the landscape of organizing.

I’ve been wrapping my head around this as a follow-up and I wanted to share with you some preliminary thoughts.

As the reader will possibly remember, in our methodology, we assume that markets are being continuously transformed through “platformization“: why is that? The point is that “platforms” offer an efficient and effective way to organize a certain market given the available technological enablers – low transactions cost, higher potential in the small players – and the desires emerging out of the market.

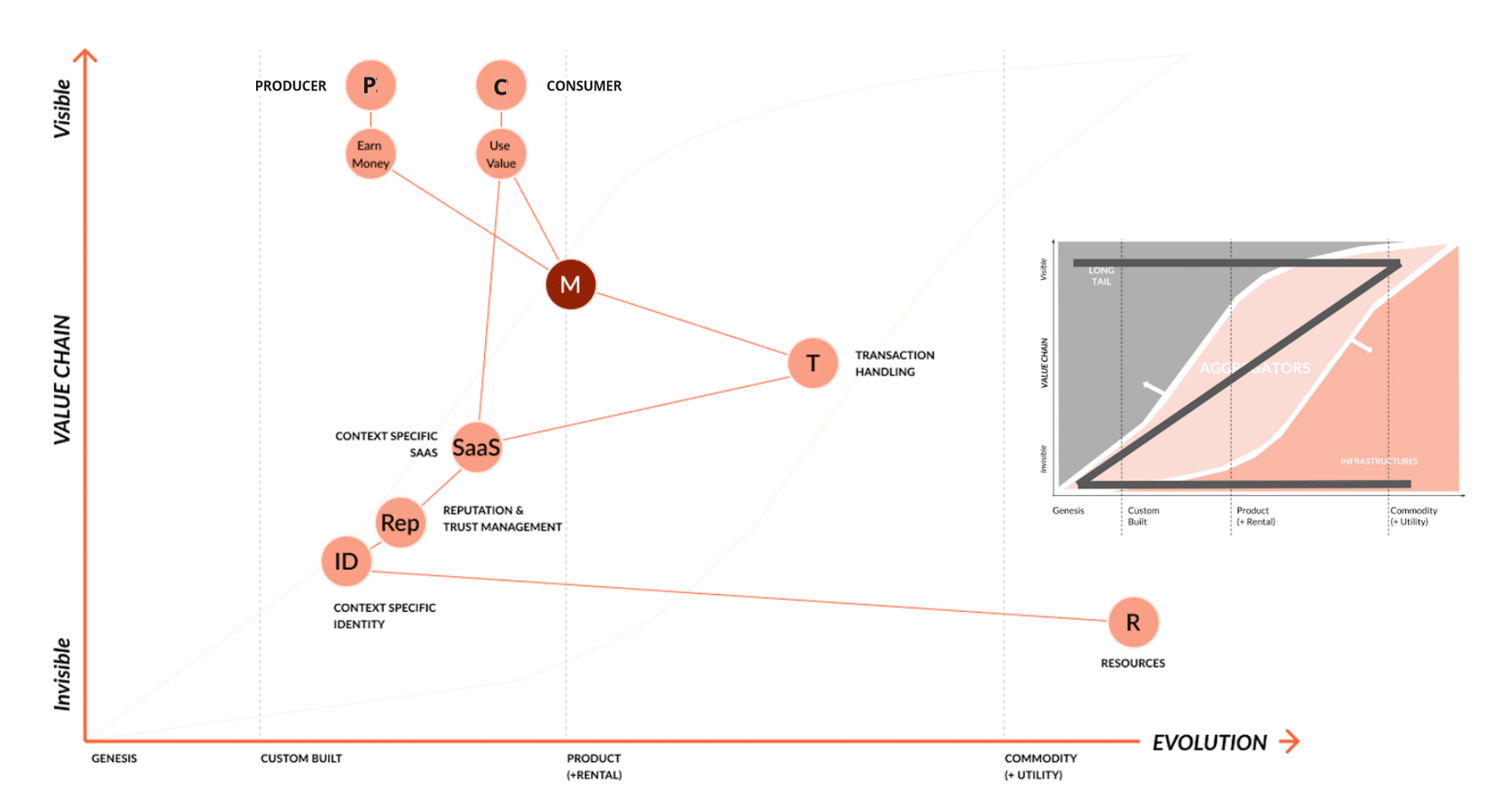

As the reader will remember as a result of the so-called “platform plays” (a thorough explanation of this is presented in our recent recap) we look at the value chain as represented in a Wardley Map as composed of:

- Producers and consumers being able to produce and consume niche value propositions;

- Mediated by a marketplace powered by rather standardized transactions (eg: credit card processing);

- A SaaS or bundle of services being provided to the producers;

- Leveraging reputation and identity that are platform specific;

- Connected with commodity resources;

the application of such a set of value chain transformations usually ends up with a Z-shapedWardley map.

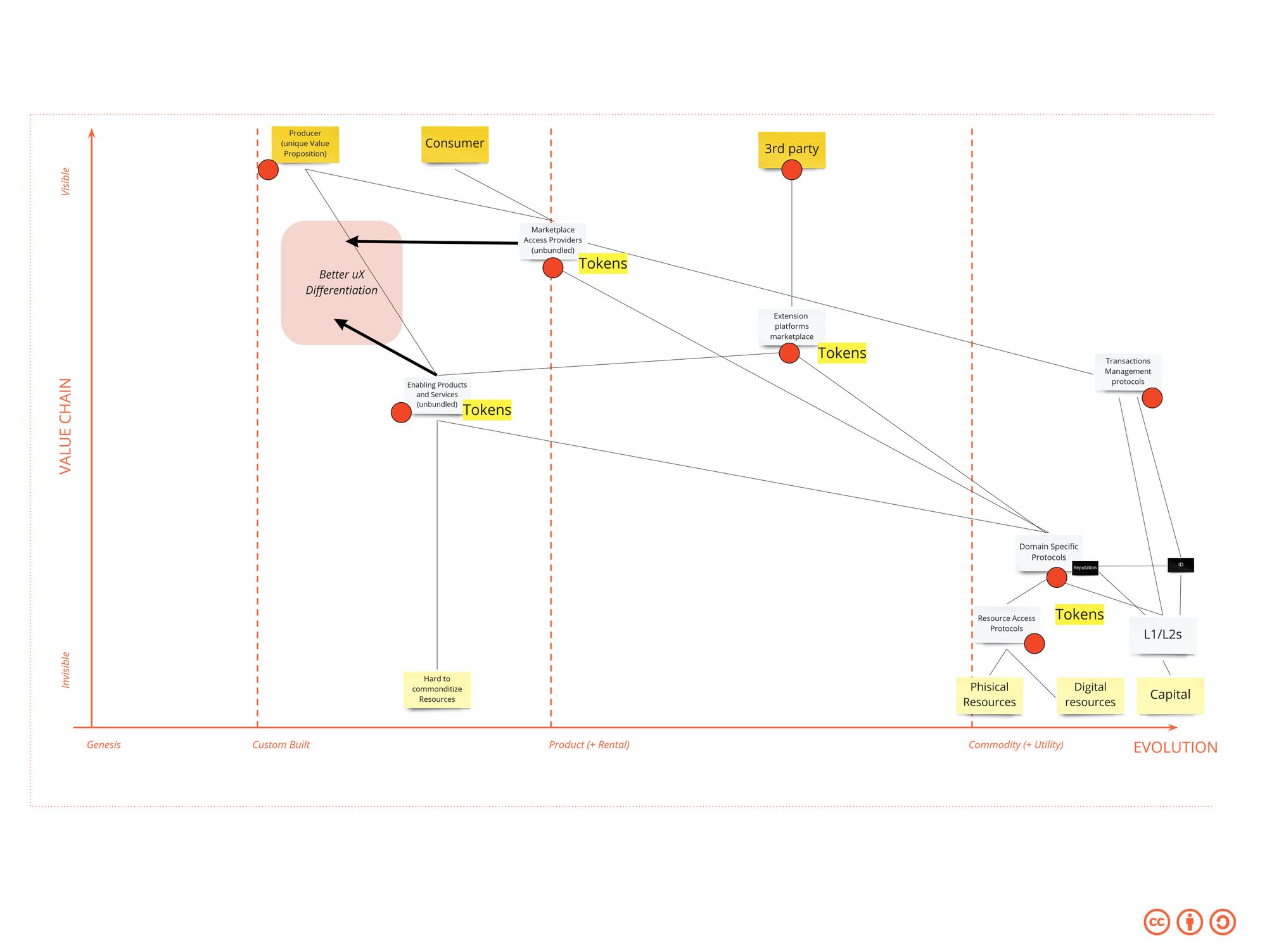

During the conversation with Ben, we noted that – as I explained in the recent post – one of the keys impacts the impact of Web3 and blockchain maybe to drive the adoption of common ontologies encoded in domain-specific protocols that could even enable different marketplaces and platforms can connect with each other. I really encourage you to catch up with the previous post to understand fully what I mean here.

Essentially what we can expect is that a common model of a certain problem domain emerges, gets codified into a user-owned protocol managed by a DAO and that differentiation moves upper layers, being them Marketplace access, Enabling Services, or Extension Platform Marketplaces (for the extension of the enabling services bundles).

But what do we exactly mean by that?

Imagine that a domain specification emerges, let’s say, for restaurant bookings. Once there’s a common protocol (most likely a couple, or a few) for that, and all restaurants have created their unique and sovereign profile on the protocol owned network, we can think of differentiation mainly moving up towards:

- Providing access to the marketplace network (with providers striving to provide the best booking flow, for example, or optimizing for certain niche markets);

- Providing services to the producers on the network (such as bundles of services optimized for restaurants, likely much more related to non-commoditized resources, location-dependent resources, such as ingredient sourcing, menus design or others);

- Providing ways for third parties to connect with such enabling services and extend them(through easy to plug “extensions”, imagine for example an ingredient provider, or a menu template provider);

How much vertical domain specificity we’ll see emerging at the domain level is yet to see: are we going to see a specification protocol emerging for “job opportunities” or “jobs in software development” or “hourly jobs”?

Are we going to see a general “commerce” protocol emerging, or one that is optimized for, let’s say, trading goods vs trading services?

The jury is out on this and we’ll likely see abundant protocols emerging and partial verticalization happen at the marketplace access layer. The capability to aggregate network effects at the domain/protocol layer, and the capability of the protocol to be supportive for adopters – for example with a specific token design or with governance choices – will likely make a difference. We can likely expect that some aggregation could happen at the market access layer – with some players aggregating high value, high conversion networks – and some aggregation to happen at the domain/protocol layer, with some marketplace access providers focusing only on providing a good UX for providers in plugging, and publicizing their offers potentially across different protocols.

Here’s where DAOs will have to evolve and find their own way of addressing the same frictions, and needs, that existing “platforms” – where the domain ontology is effectively bundled with the organization – have managed to achieve industry incumbency: think of Airbnb or Uber, that gained a de-facto standard position in their industry.

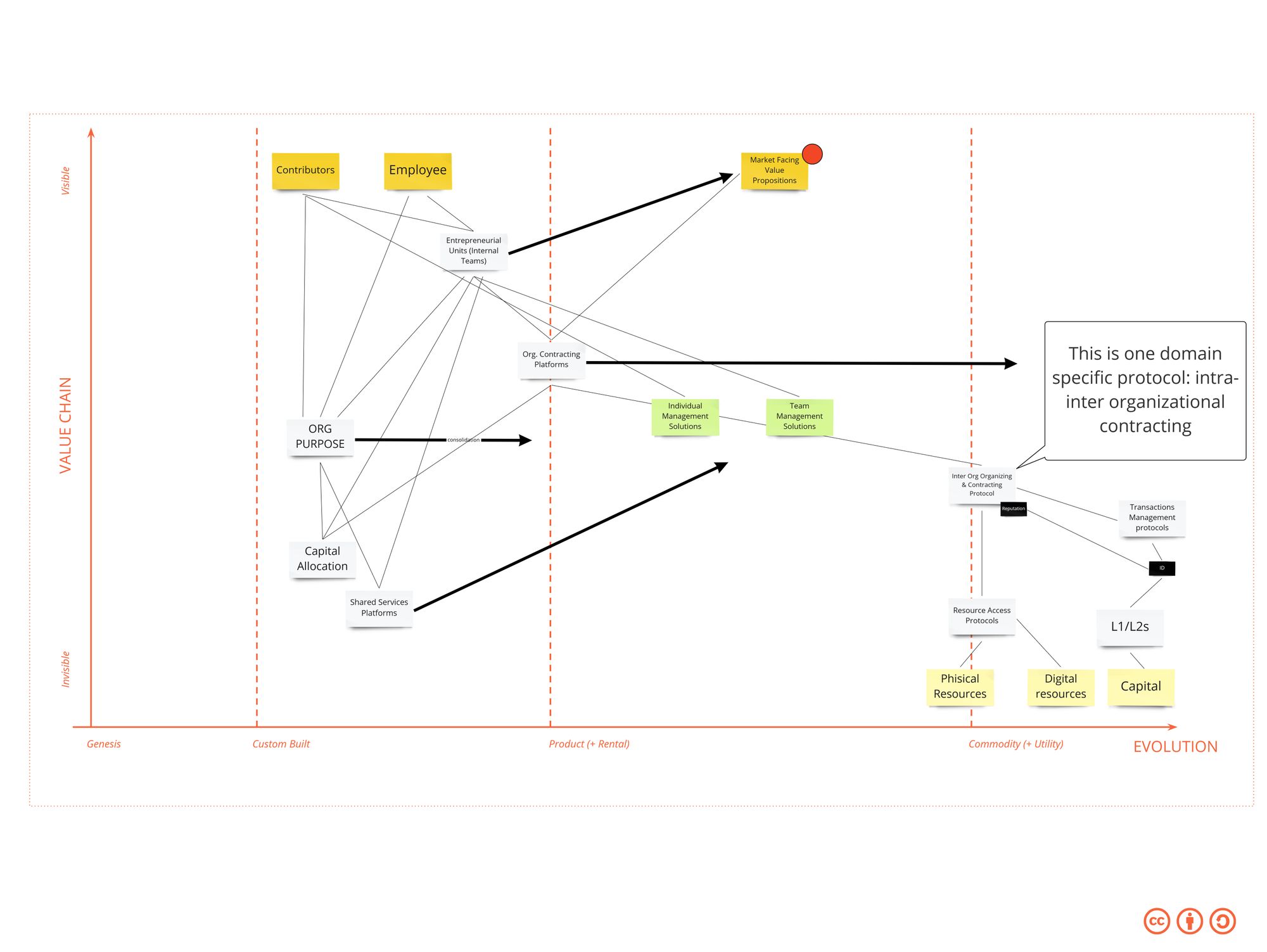

Here’s how we can picture this from a Wardley Map perspective:

As one can see I foresaw at least three types of protocols emerging in this picture, but likely more will have to emerge:

- Transactions Management protocols (equivalent to credit card processing, instant-loans… to some extent integrating, extending, and transforming the space of “embedded finance”);

- Domain Specific Protocols (as explained above);

- Resource Access Protocols that may be needed to streamline access to tangible resources pools.

Tokens could be used at many places in the picture above: we can certainly expect protocols to issue tokens to strengthen their position in the competition for adoption.

Intelligent use of tokens would make token allocation possible through the upper layers that will decide to implement the protocol itself (eg: the multiple Marketplace access), but also upper layer players such as those in marketplace access, extension platforms, and enabling services may use their own token to attract users.

Lastly, as you can see above I added some red dots to the picture, and you’re probably wondering: why is that? Well, these red dots represent elements of the map that will likely have to be produced by… an entrepreneurial organization of some kind.

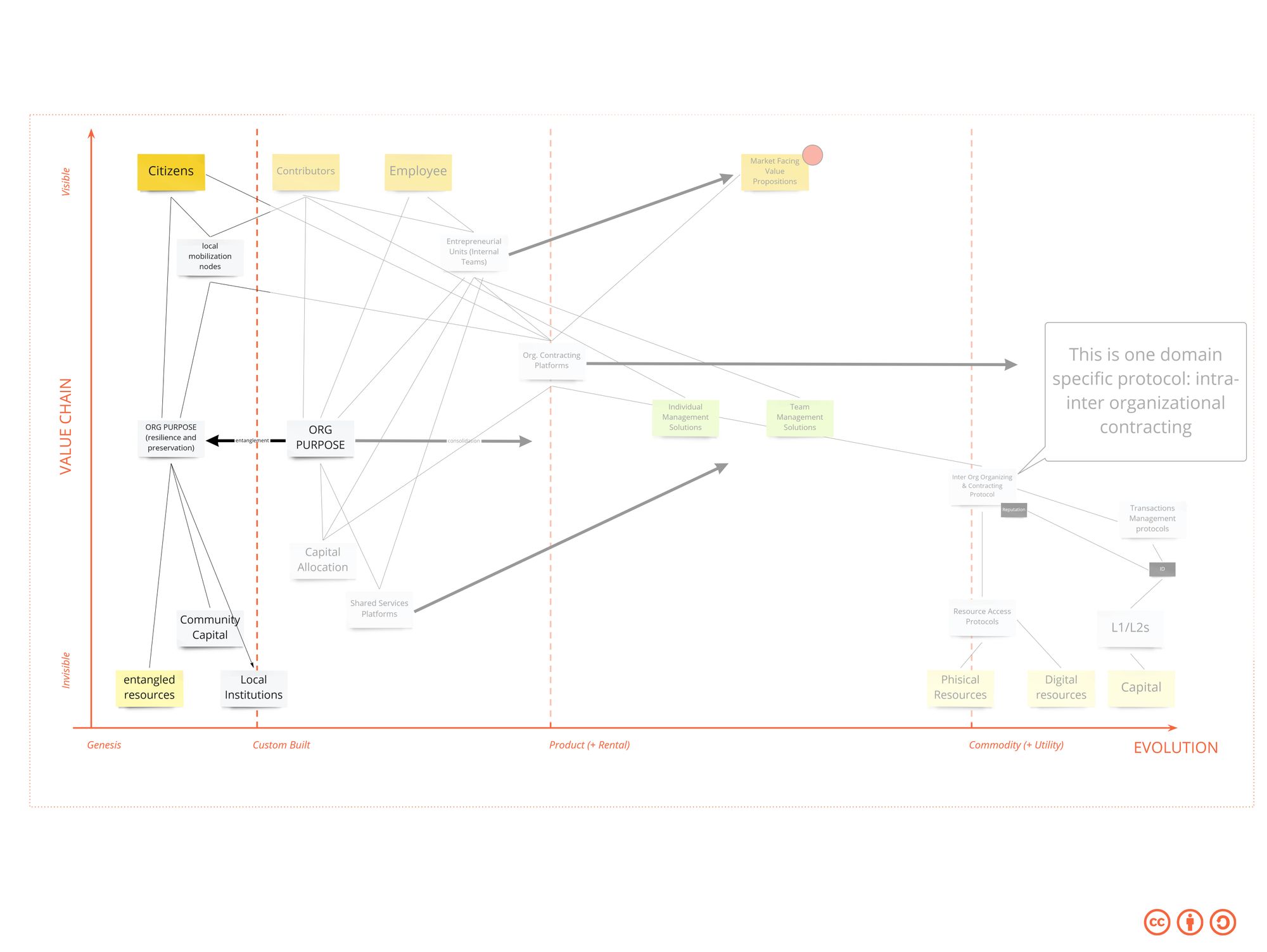

I built a second map that you can see below that looks more specifically into the evolution we could expect in the space of how organizations produce outcomes. There, I also added red dots to identify where is the connection with the other map: where entrepreneurial teams will produce market-facing value propositions.

If you look to the top, you see employees and contributors: they’re both connected with the “organization purpose”: the assumption here is that as organizations become more fluid the organization’s purpose becomes an attractor of contributions.

Then, such elements are connected also to an “Org. Contracting Platform” that, in turn, is connected with what I called an “Inter Org. Organizing & Contracting Protocol“.

What are those? Well, similarly to how we can expect trade and other domains to evolve towards protocol enabled inter-operability this can be expected for how organizations work and thus expect that one (or multiple) protocols emerge for that as well as platforms that leverage these protocols to provide organizations a way to connect their teams into a global network for inter-org cooperation.

As we see organizations unbundle beyond bureaucracy we believe that we’ll need common protocols that facilitate and regulate how organizations achieve things such as funding a new product team, allocating skin in the game to participants, doing collaborations through patterns such as revenue or equity sharing agreements and so on. As an example, you can imagine two companies co-investing to create a new product, with employees interested in becoming the entrepreneurs kickstarting the process, and getting access to future equity: such a multi-org node will have to collect funding, commit to certain results, agree on the cap-table at the formation and after validation, will have to agree on how the upsides of a potential market success will be distributed.

At Boundaryless we believe that protocols for inter-organizational cooperation will emerge, and we’re actively working to fund an initiative in the space (reach out directly if you’re interested to invest capital or join as a partner or apply to this form). We’re seeing similar convergence with how some players such as Boson Protocol, which is trying to formalize and standardize commerce, or Prime DAO, with Prime Launch or Prime Deals is trying to standardize DAO creation and DAO cooperation, are currently trying to bring more inter-operability to the market.

Having said that, you’ll see how Organizational Purpose sits on top of two key other elements, we’ve been widely talking about in the opening of the piece: capital allocation capabilities and shared services platforms both aiming to support the creation of more entrepreneurial teams inside the organization.

We assume that there will be an evolution in purpose as consolidation will drive organizations with similar purposes towards convergence (this is happening already if you think how consolidation has taken over spaces such as telco, or media) and that hared services platforms providing enabling services will productize into solutions that are optimized either to support teams or individuals, most likely working across organizations, according to the “unbundling of the Fordist bundle“, a pattern that is rapidly consolidating.

Organizations will then have to evolve in a way to spur up units that will have to address the opportunities on the market as highlighted above.

Such units will either have to (see red dots):

- Become niche providers of services and products with unique value propositions and access the market through marketplaces access providers;

- Become marketplace access providers themselves;

- Produce (possibly in combination with marketplace access) domain-specific enabling products and services;

- Produce extension platform marketplaces to help third parties connect and extend enabling products (possible as well produced by them);

- Create new protocols and bootstrap networks around them;

....Or just do a bit of a mix of this all.

Lastly, we can likely expect a highly local context of work and contribution to emerging for everything that is entangled with localities, with organizations that are missionized to take care of resilience and preservation of landscapes and communities, most likely around the foundational economy where people will be able to contribute more as citizens, through local mobilization nodes, leveraging local community capital, entangled resources and the cooperation with local public institutions.

Conclusions (for now)

In this post, we tried to offer a comprehensive – albeit initial – overview of how DAOs represent a new but still immature, pattern of organizing and how this pattern should learn from and inter-work with existing emerging approaches to post-bureaucratic organizing.

Despite this work is incomplete and in the early stage, we believe that anyone currently having a key role in a DAO design and development process should consider learning how to organize internally more effectively and that existing corporates and SMBs should strive to learn how DAOs and protocols will have an impact on their reference markets.

Do you want to learn how to create entrepreneurial and ecosystemic organizations?

Join us at the upcoming 3EO Masterclass in September:

Before You Go!

As you may know, everything we do is released in Creative Commons for you to use. In case you’re getting value out of these reads and tools, we encourage you to share with your friends as this will help us to get more exposure, and hopefully, work more on developing these tools.

If you liked this post, you can also follow us on Twitter, we normally curate this kind of content.

Thanks for your support!