What could go wrong in decentralised autonomous organisations?

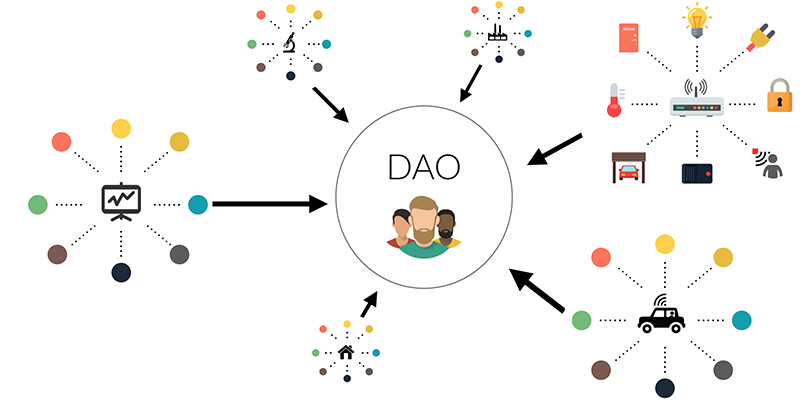

In a perfect world every DAO should be decentralised and autonomous, with an edge over traditional forms of organisations, such as companies.

DAOs can coordinate expansive networks of human resources and capital across the globe. DAO communities should be able to make swift decisions without power hierarchies, to create velocity and be efficient. DAO treasuries can become self-sustaining (and profitable?).

So with all these (and more) benefits, what are the risks?

🚩 Red flags

- Lack of Knowledge: DAO stands for decentralized autonomous organisation, which in theory should be accessible to people worldwide. However, in practice, there is still a lack of awareness and knowledge around what DAOs are and how they function. This barrier is further compounded by the fact that most people who are interested in crypto are only looking to make a quick profit. It can be difficult to find potential contributors for your DAO who have both the expertise and the motivation to work on a decentralised project.

- Lack of Expertise: Hiring for any web3 project is notoriously complex, and people with the skills come with a hefty price. It would help if you had experts in community growth, people with in-depth tooling knowledge, familiar with governance, a treasury with deep liquidity and experts in managing the treasury. One way to find an initial core team with the expertise to start and run a DAO is to look for people who have already been involved in successful DAOs. These people will likely have the necessary skills and experience to help get your DAO off the ground. Additionally, they will also be familiar with the challenges and obstacles that come with running a DAO, which can be invaluable when it comes to troubleshooting and problem-solving.

- Lack of Compliance: DAOs are intended to function as trustworthy, decentralized and democratic organisations, powered by smart contracts and governed by token holders. But this is not always the case in practice. A high-profile example is the so-called "Wonderland saga," in which the co-founders of this DAO did not know each other's real names and a billion-dollar treasury later vanished. Another example is the QuadriqaCX exchange, which was popularised by a recent Netflix documentary. This exchange allegedly stole millions of dollars from a DAO's treasury, leading to the collapse of the TIME token. These examples illustrate the risks associated with investing in DAOs. When you invest in a DAO, you are trusting that the individuals behind it are honest and competent. However, as these examples show, this is not always the case.

- Hacks and exploits: The original DAO should serve as a reminder of the potential perils. Just three months after launching on Ethereum, The DAO was hacked, forcing Ethereum to fork. To put this into perspective, this historic fork happened after a $60 million hack, whilst over just this past quarter, according to Immunefi, more than $1.23 billion was lost as the result of crypto hacks and fraud.

- Treasury management: DAOs are subject to the same volatility as the underlying asset classes they invest in. While many DAOs try to build up a large reserve of stable coins, this can quickly become depleted. DAOs turn to more yield-generating investments to keep the treasury afloat. Most DAOs follow the same playbook, an allocation to convex, Curve, Redacted Cartel for bribes and stable coin yield protocols. A collapse in Curve would have cascading effects on multiple treasuries. The key is to diversify yourDAO's holdings across different protocols and asset classes. By doing so, you can protect your DAO from black swan events and ensure that it continues to generate returns for its members.

- Governance exploits: One of the main attractions of a DAO is that it offers a decentralized form of governance, where anyone can join and have a say in how the organisation is run. However, this decentralized governance model also opens up the possibility of corruption. If a few wallets own 51% of the voting power or collude to hold 51% of the voting power, they can effectively control the treasury or pass votes in their best interest. This is known as a Sybil attack, which allows a small group of people to control the entire organisation to undermine the democratic process and potentially misappropriate DAO treasury funds.

- Regulatory and operational risks. Because DAOs are so new, there is no existing framework to regulate and tax them. This creates a number of practical challenges and dilemmas, such as: Should a DAO pay a member in a sanctioned country? How do you offer health benefits or a savings plan to a member in an unfamiliar country? How do you pay someone in a country with no crypto off-ramp? What accounting software do you use?

To DAO or Not To DAO?

Be aware of the risks and challenges, but as DAOs are not bound by geographical borders or traditional organisational structures, they have the potential to radically change the way we coordinate and cooperate.

While the idea of DAOs is still in its infancy, there are already a number of different types of DAOs that are being created, including legal DAOs, security DAOs, treasury DAOs, tooling DAOs, and consulting DAOs.

Some of the brightest minds in the blockchain space are working on the challenges of creating, governing and managing DAOs.

Join a DAO, or launch your own. You will certainly have some fascinating stories to tell in future about how you were part of the early days of the DAO movement.