TL;DR

In a world shaken by the fragility of traditional alliances and the escalating fractures of geopolitical conflict, we must see that we are standing at the threshold of a new era of global cooperation—one defined not by bullies, borders or bureaucratic gatekeepers, but by decentralised networks and communities empowered by blockchain and crypto-economic innovations.

Imagine a future where the Internet of Impacts connects millions of people across continents in peer-to-peer networks, seamlessly exchanging economic value, knowledge, and trust without relying on centralised authorities.

This is not mere idealism; it’s an achievable vision that technology platforms like IXO are already making possible. At a time when isolationist policies and trade wars threaten global stability, decentralisation offers a hopeful alternative—an inclusive, resilient digital immune system that enables humanity to collaboratively tackle climate change, sustainable development, and humanitarian crises, directly and transparently.

Trade Wars with Economic Weapons

The sage Warren Buffett has put it bluntly: “Tariffs are an act of war…They’re a tax on goods…And then what?” –meaning the longer-term outcomes could spiral unpredictably.

Economists and financial observers are alarmed at the potential damage from the recent escalation. The Financial Times bluntly described “the absurdity of Donald Trump’s trade war” noting that these tariffs on Canada, Mexico, and China will deliver an immediate shock to the North American and world economies . By abruptly raising trade barriers with major markets, the U.S. has “fired the first shots in what threatens to become a devastating trade war” as the FT warned.

Overall, the consensus among many economists and publications is that Trump’s trade gambit risks significant collateral damage: it threatens to raise costs for households, unsettle global supply chains, and possibly derail the post-pandemic economic recovery.

Disrupting International Cooperation and Trade

Beyond the immediate economics, this escalation is straining the fabric of international cooperation. The tariffs have provoked unprecedented rifts between the U.S. and its allies. Canada’s and Mexico’s leaders, traditionally close U.S. partners, responded in anger and with countermeasures, signalling a breakdown in goodwill. Canada is not only retaliating with its own tariffs but also planning to challenge the U.S. action through the dispute mechanisms of the WTO and the USMCA trade agreement. Such legal challenges indicate that global trade institutions are being pulled into the fray, potentially testing the integrity of the rules-based trading system. If the U.S.–historically a champion of that system–is seen as flouting rules or ignoring WTO rulings, the result could be a weakening of international trade governance.

Allies in Europe and Asia are likewise on edge. European Union officials are bracing for the possibility that they could be the next target of tariffs, given President Trump’s past threats and his stated view that trade deficits must be corrected aggressively. The EU has been warned by these moves that “any illusion they will be spared” is misplaced. This atmosphere risks fragmenting global trade into hostile camps. Instead of cooperation on common challenges—from supply chain resilience to climate change—major powers may become more preoccupied with tit-for-tat economic nationalism.

Diplomatically, the tariff war is undermining trust and goodwill. Longstanding alliances are fraying as economic aggression replaces collaboration. The Financial Times observed that Trump is attempting to “redefine the existing international order”—not just with rivals like China, but even with traditional allies like Europe, Canada, and Mexico. Joint initiatives, whether on trade, security, or global health, become harder when key countries are locked in economic conflict. For example, coordination through G7 or G20 forums could suffer if members are retaliating against each other’s trade measures. In summary, the tariff escalation is eroding international cooperation at a time when global coordination is needed on many fronts. It exemplifies how quickly decades of trust can be jeopardised, leaving the global community more fragmented.

Broader global economic stability is also at stake. If multiple countries resort to protectionism in response, we could see a rollback of globalisation–reduced trade flows, isolated markets, and inefficient duplication of supply chains. Smaller export-driven economies are particularly vulnerable to a downturn in global trade volumes. Some nations in Asia—such as Vietnam or India—might seek to capture opportunities as supply chains realign, potentially benefiting in the long run. However, a prolonged trade war would likely be a “lose-lose” scenario for the world economy, reducing overall growth. As one Financial Times analysis put it, this is—as quoted by Justin Trudeau—“the dumbest trade war in history”, harming even the country that started it. With international institutions strained and trust in short supply, many are asking what alternatives exist to mitigate the fallout and maintain exchange and cooperation beyond the confines of traditional trade channels.

The Alternative: Network States

In the face of this breakdown of traditional economic order, blockchain technology and decentralised networks are emerging as promising solutions. These technologies can enable individuals, businesses, and communities to continue exchanging value and collaborating directly, peer-to-peer, without reliance on traditional gatekeepers. In essence, Web3 tools provide a parallel infrastructure for global commerce and cooperation – one that is more resilient to geopolitical disputes.

Bypassing gatekeepers

Blockchains are often described as “trustless” or “permissionless” networks, meaning no central authority is needed to validate transactions or grant access. Decentralised finance (DeFi) disempowers gatekeepers and middlemen while empowering users via peer-to-peer exchanges on a public blockchain. In practical terms, this allows a merchant in one country to transact directly with a customer in another, without requiring banks, payment processors, or government institutions to intermediate. Even if banks tighten credit or if international payments are restricted due to a trade war, two parties can still do business using cryptocurrencies or stablecoins that move over the internet. For example, a U.S. importer facing high tariffs on goods might directly pay an overseas supplier in cryptocurrency, potentially avoiding some currency exchange frictions or capital controls. While this doesn’t erase the tariff on the physical goods, it does bypass financial barriers and delays that arise when traditional channels are disrupted.

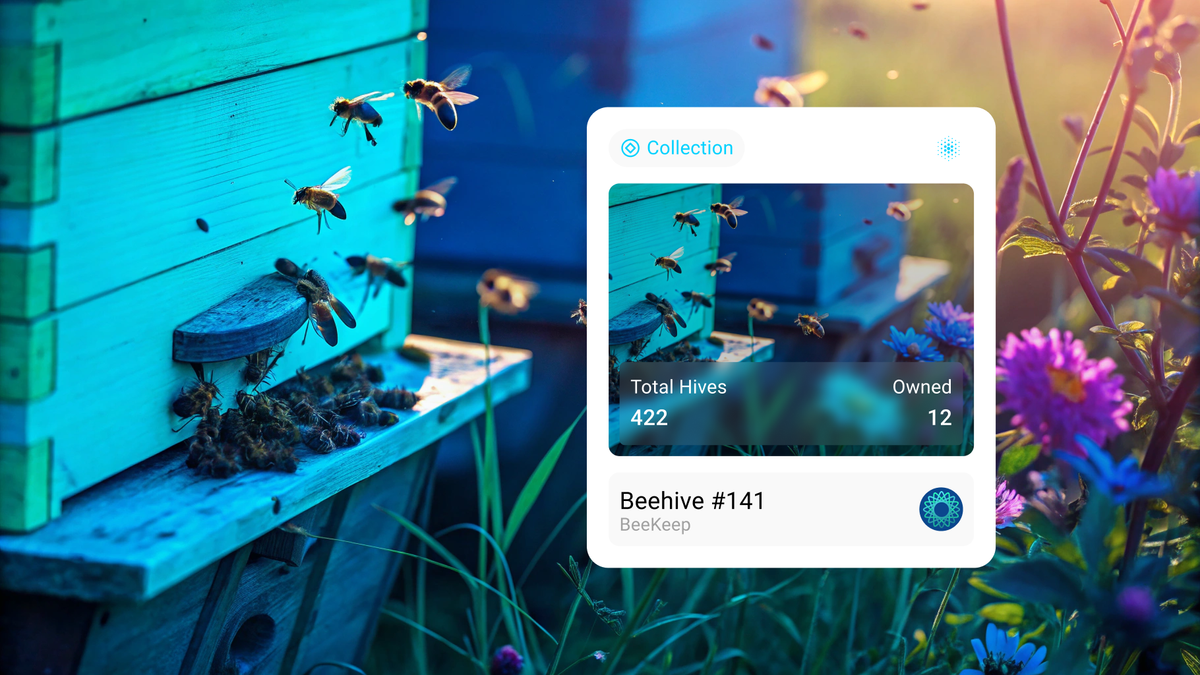

Projects like IXO exemplify how decentralised networks can bypass traditional gatekeepers. We have been building what we envision to become an “Internet of Impacts” through which networks of people and organisations can coordinate and exchange impact investments and data directly. By providing protocols for “proof of impact” IXO enables funders to directly support social or environmental projects anywhere in the world, with outcomes verified on-chain and without reliance on big institutions and traditional intermediaries. This model has a broader implication: if peer-to-peer networks can verify and trade intangible assets—such as carbon credits or impact certificates—globally, the same principles can apply to more traditional trade. Decentralised marketplaces could arise where producers and consumers connect without Amazon-like central platforms controlled by U.S. monopolies, and where reputation and trust are managed via blockchain. In a scenario of tariff wars, such marketplaces might route around government-imposed barriers—for instance, by focusing on digital goods, services, or tokenised assets that aren’t as easily hampered by border tariffs.

Resilient supply chains and finance

Blockchain can also help build more resilient supply chains in a fractured trade environment. Distributed ledger technology can verify provenance and track goods through complex supply chains, which becomes crucial if companies need to re-route trade through neutral or friendly countries to avoid tariffs. Smart contracts might automate tariff payments or insurance payouts, reducing uncertainty. Moreover, businesses can turn to decentralised finance for liquidity if banks in one country restrict lending due to trade tensions.

Using DeFi protocols, a company in an affected country could secure a loan in crypto-collateralised funds or find global investors who lend directly, sidestepping domestic capital controls. This “permissionless” access to financial services means even if governments impose bans or restrictions, businesses can often find a way to transact digitally. For example, during past sanctions and trade bans, some Iranian and Russian importers reportedly used cryptocurrency to settle payments and keep goods flowing. Similarly, amid a tariff war, parties could agree to use a stablecoin (a cryptocurrency pegged to a stable value) for cross-border trade settlements, minimising reliance on banks or SWIFT transfers that might be vulnerable to political interference.

Decentralised networks offer an alternative rail for global trade and finance. They replace institutional trust with cryptographic proof, allowing any participants with an internet connection to do business. This can mitigate some impacts of geopolitical conflict, by ensuring that at least the financial exchange part of trade can continue smoothly even when traditional channels are under siege. However, it’s important to note that while blockchain can move information and money freely, it cannot by itself eliminate physical tariffs on goods crossing borders. What it can do is reduce other frictions—in payments, financing, data sharing, and contractual enforcement—thereby softening the blow of a trade breakdown and keeping peer-to-peer commerce alive.

Alternative States

The idea of network states—popularised by Balaji Srinivasan—is turning into a global movement. A Network State is essentially a digital-first community that organises like a nation—with its own members, economy, and governance—without being confined to one geography. Such communities can eventually coordinate physical footprints—like distributed enclaves or charter cities—but their core unity is through the internet and blockchain.

Think of the network state like a tech startup company with its own cryptocurrency—instead of declaring sovereignty outright, it first builds a community and digital systems online.

In the context of a trade war that is fragmenting the global economy, network states offer a radically different path: voluntary, transnational economic networks that people opt into. Imagine thousands of entrepreneurs, engineers, or creatives across many countries who band together in a digitally-native economic community. They might create their own crypto-token that functions as a currency within this community, and smart contracts that govern their internal trade policies. Members could trade services and digital products with each other freely, forming a sort of parallel economy that isn’t easily controlled by any one nation’s tariffs or sanctions.

If these networked micro-economies gain scale, they could start to “pick up the slack” where traditional trade relationships falter. For instance, if certain countries block each other’s tech exports, a network of tech professionals across borders could still collaborate and exchange value through a decentralised platform, essentially creating a borderless talent and capital market.

We are already seeing hints of alternative models in response to geopolitical stress. Some countries have explored bilateral cryptocurrency arrangements for trade—bypassing the U.S. dollar system—and groups of citizens have formed global Decentralised Autonomous Organisations (DAOs) to pool funds for common goals. These can be seen as embryonic network states—communities with their own treasury, rules, and missions, operating online. One example is the concept of an “Impact DAO” that globally funds climate initiatives, effectively acting as a decentralised multilateral institution that is run and governed by token holders rather than nations. Such structures could maintain international cooperation on critical issues even when formal alliances between governments break down. They represent an alternative geopolitical structure: one built on shared values and secured by blockchain, rather than on treaties and state power alone.

Community Currencies

Community currencies can be used in regions hit by trade disruptions, where communities adopt cryptocurrencies or implement local digital voucher schemes to facilitate trade when official currencies or banking systems are unstable. For example, farmers in one country could trade food directly for the tokens of a miner in another country, with the token exchanges handled on a blockchain that provides trust and liquidity. This harks back to barter and local currencies but turbocharged by global connectivity—a mesh of micro-economies that together form a resilient web. While such systems are still nascent, the advancement of blockchain tech makes them increasingly feasible. They could complement network states by ensuring that even at a grassroots level, people have alternatives to reliance on national economic systems when those systems become weaponised or unreliable.

In essence, network states and alternative crypto-economic models create options for global cooperation that do not depend on governments. They could preserve flows of trade, knowledge, and capital among willing participants even as nation-states turn inward.

Of course, these concepts also raise new challenges—questions of regulation, legitimacy, and inclusivity—but they showcase the innovative responses that can emerge when traditional systems falter. Just as the late 20th century saw the creation of multinational institutions to govern trade, the coming years might see the rise of blockchain-governed networks picking up that mantle in a new form.

Opportunity in Times of Crisis

Despite the turbulence caused by the tariff war, this moment also highlights strategic opportunities to leverage Web3 innovations for resilience and growth. Businesses, communities, and even governments willing to think outside the box can take actionable steps to buffer themselves against protectionism and to build new avenues of cooperation. Below are several solutions-oriented strategies that can be pursued now to harness blockchain and decentralised technologies in this shifting landscape:

- Adopt Decentralised Finance for Trade Payments: Companies engaged in international trade can start using cryptocurrencies and DeFi platforms for cross-border transactions. For example, instead of relying solely on traditional banks (which might be hampered by trade sanctions or higher fees), firms can use stablecoins to settle import/export payments. This approach bypasses potential banking blockades, reduces transaction costs, and accelerates settlement times. It also diversifies currency exposure—a useful hedge if trade tensions destabilise fiat exchange rates. Importantly, decentralised finance can help businesses circumvent bans and restrictions that might arise in a trade war scenario, ensuring that the flow of payments doesn’t stop even if political conditions worsen.

- Build Resilient Supply Chains with Blockchain: Organisations should invest in blockchain-based supply chain management. By recording provenance and shipment data on a tamper-proof ledger shared among suppliers, manufacturers, and shippers, companies can maintain trust in their supply chains even as geopolitics shift. If a particular trade route becomes unviable due to tariffs, a blockchain system can quickly help reroute goods through alternative partners while maintaining transparency about origin and quality. In addition, smart contracts can be used for automated compliance—calculating tariffs or taxes owed in real time—and for instant insurance or payment releases when goods arrive, reducing delays at ports. This streamlining can offset some of the inefficiencies introduced by new trade barriers, keeping goods flowing to where they are needed.

- Join or Form Decentralised Trade Networks: Industry consortia can form decentralised networks or DAOs to facilitate peer-to-peer exchange of goods and services. For instance, a group of businesses across different countries could create a consortium blockchain or marketplace where they trade directly with one another under agreed rules, effectively a private free-trade zone on the blockchain. Token incentives could be used to reward members who, say, source from within the network despite external tariffs. Such arrangements reduce reliance on third-party platforms and political agreements, since the rules of trade are encoded and enforced by the network participants themselves. Over time, these networks could evolve into larger “network states” of commerce, attracting more members who seek stable trading relationships outside of government interference.

- Empower Communities with Direct Access Platforms: Projects like IXO show that ordinary people can directly fund and support projects worldwide without traditional gatekeepers. Expanding this idea, development agencies, NGOs, or entrepreneur groups can use blockchain platforms to match resources to needs across borders, regardless of geopolitical frictions. For example, if two countries halt official trade, farmers and consumers in those countries could still connect through a decentralised food exchange, or students and educators could swap e-learning services via NFTs with tokenised incentives and payments. By fostering many-to-many connections, Web3 platforms can maintain international links at the grassroots level, alleviating some human costs of a trade cutoff. Investing in user-friendly decentralised apps for remittances, crowdfunding, and B2C ecommerce is an actionable step that creates economic lifelines immune to high-level disputes.

- Explore Network State Membership and Governance: Forward-thinking individuals and organisations might consider participating in emerging network states or online cooperatives. This could mean joining an existing digitally governed community that aligns with one’s industry or values, or helping to found new ones. By doing so, companies could gain access to an alternative market and talent pool that operates by its own rules. For instance, a tech firm could join a network state of tech developers around the world who share tools and even a common cryptocurrency for services—providing a backup marketplace if international agreements fail. On a governance level, experimenting with blockchain-based decision-making—for example, using tokens to vote on shared resources or standards—can pave the way for more agile and democratic coordination than traditional trade forums allow. These experiments today could become the blueprint for the more flexible economic blocs of tomorrow.

- Invest in Education and Infrastructure for Web3: Finally, a practical but crucial step is to continue building capacity for Web3 adoption. Governments and businesses should support education on blockchain and crypto tools, ensuring that more people can engage in decentralised commerce safely and effectively. Simultaneously, investing in the necessary digital infrastructure—from internet access to blockchain development platforms—will make it easier to deploy these solutions at scale. For example, training programs for small exporters on how to use smart contracts for international sales, or ensuring legal clarity around cryptocurrency use, can significantly lower the barrier to entry. Embracing regulatory innovation—like recognising DAOs or clarifying the status of digital assets—is also strategic; jurisdictions that do so could become hubs for the new decentralised economy, attracting talent and capital as global systems realign.

Changing the State of the World

The current tariff war and disruptions in geopolitical relationships will undeniably put stress on the global economic system and will undoubtedly change how the world operates—with emergent new dynamics. The insights from respected publications underscore the severity of the situation—a shock to the world economy and a perilous moment for international harmony.

But this also spotlights the importance of innovation in how we organise trade and cooperation. While governments clash with tariffs, technology is empowering people to form new connections and economies beyond traditional borders. By doubling down on blockchain, crypto, and the ethos of decentralisation, we can begin to de-risk our world from such political shocks. Web3 offers ways to keep markets open, foster trust through code, and build communities that transcend legacy divisions.

In a landscape defined by uncertainty, these decentralised solutions provide a hopeful path forward—one where trade and collaboration become more resilient, equitable, and directly in the hands of the people involved. The tariff war may be re-drawing the map of global commerce, but with strategic adoption of Web3 innovations, stakeholders can redraw it on our own terms—creating a networked global economy that can weather storms and seize new opportunities.

Connect with IXO World